Tech Solutions for India’s Unclaimed Insurance Crisis

Introduction

-

As per estimation, around ₹20,000-22,000 crore worth of money is unclaimed. source livemint

-

An insurance policy will be marked unclaimed if it is not withdrawn within 6 months of maturity. Unclaimed money will be transferred to the Senior Citizens’ Welfare Fund (SCWF) on or before 1 March of the financial year.

-

Insurers are also instructed to communicate with policyholders and share their approaches with regulators. Moreover, they are to create a digital facility for customers to check their unclaimed money without visiting physical offices.

-

According to estimates, around 7 million policies are unclaimed. Efforts without technology and a deep connection with the public/private data repository will be time-consuming and expensive.

-

At Insurnest, we have devised the approach of skipping-tracing customers with the help of technology and physical approaches.

What is Skip Tracing ?

-

A specialized procedure called "skip tracing" is used to find people who have moved or are purposefully avoiding detection. It is a common tactic used by debt collectors, private detectives, and attorneys. Skip tracing combines a variety of investigation methods with access to several data sources. Experts in this domain examine public documents, databases, social media sites, and other digital assets to get details on the individual they are seeking to find.

-

Records pertaining to real estate, utility bills, driver's licenses, and other documents may be included. Skip tracing is useful for finding debtors, those avoiding court cases, and family reunions. However, operators must stay within the law and respect people's privacy rights. Expert skip tracers frequently combine perseverance, ingenuity, and investigation expertise to meet the difficulties of tracking down those deliberately attempting to hide.

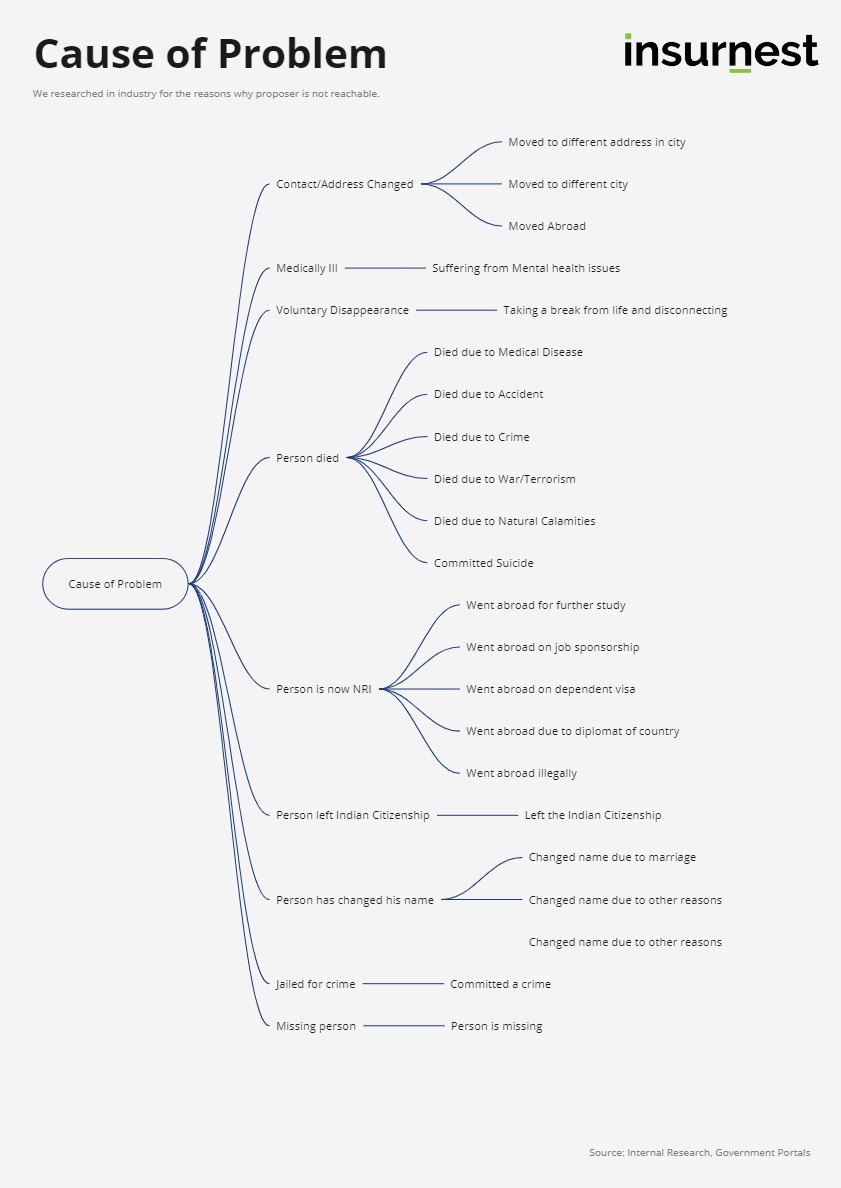

What are the root causes of unclaimed money?

1. A Person Has Changed his Contact/address

- A person has changed his contacts for several reasons, such as if his SIM card is missing, his mobile or SIM card has been stolen, etc. There are also several reasons for the address change, which are below.

A. Moved to a different City

- People move to different cities for several reasons, such as to study, get a job transfer, etc This can be the root cause of unclaimed money.

B. Moved To a different address in the City

- A person may have moved to a different address in the city for several reasons, such as if the person's house goes into redevelopment or has purchased a new house in the same city. This can be the root cause of unclaimed money.

C. Moved Abroad

- A person has moved abroad for several reasons like studying, getting a transfer abroad in a job, etc. This can be the root cause of unclaimed money.

2. Medically ill

- A person is medically ill for several reasons, as follows:

A. Suffering from mental health issues

- If the person has a mental illness, they will isolate themselves, and also they are unable to make contact with anyone. This can be root cause for unclaimed money.

3. Voluntary Disappearance

- A person has taken a voluntary disappearance due to several reasons, which are below.

A. Taking a break from life and disconnecting

- A person has taken voluntary disappearance due to some personal reasons, is mentally unable to handle the pressure, etc. This can be the root cause of unclaimed money.

4. Person is Died

- A person has died due to several reasons, which are as follows.

A. Died due to medical disease

- A person has died due to some medical disease like cancer, liver disease, kidney disease, cancer, etc. This can be root cause for unclaimed money.

B. Died Due to the Accident

- A person has died due to the accident. It happens for several reasons, such as the vehicle's high speed, sleep while driving, etc. This can be root cause for unclaimed money.

C. Died Due To Crime

- A person has died due to the crime, like other people have been murdered due to the reasons.This can be root cause for unclaimed money.

D. Died Due To War/Terrorism

- A person has Died in a war between two countries or states. This can be the root cause of unclaimed money.

E. Died Due To Natural Calamities

- A person has died in natural calamities like earthquakes, floods, cyclones, wildfires, volcanoes, etc. This can be root cause for unclaimed money.

F. Committed Suicide

- A person has committed suicide for several reasons, like a person who is mentally disturbed, a person who might not achieve goals, etc.… This can be the root cause of unclaimed money.

5. Person is now NRI

- A person becomes an NRI for several Reasons, which are as follows.

A. Went Abroad For Further Studies

- A person has gone abroad for studies for several reasons, like the courses he selects are not available in India, and the education system is better abroad than in India. This can be the root cause of unclaimed money.

B. Went Abroad on job sponsorship

- A person goes abroad on job sponsorship for several reasons, such as companies making a transfer of the person due to a shortage of employees in the abroad branch, a person getting a better package in the abroad-based company, etc. This can be the root cause of unclaimed money.

C. Went abroad on a dependent visa

- If one family member goes abroad, then other family members can go abroad using a dependent visa. There are several reasons for this, like job increments, transfers, etc. This can be the root cause of unclaimed money.

D. Went Abroad Due to diplomat Country

- In this way, some government officers have to move abroad as part of their duties. This can be root cause for unclaimed money.

E. Went Abroad illegally

- If a person cannot get a passport or visa, he will try to illegally enter the borders of countries abroad. This can be the root cause of unclaimed money.

5. A person has left Indian Citizenship

- A person may have left Indian Citizenship for several reasons, such as acquiring Citizenship in other countries, dual citizenship restriction, or family reasons. These can be the root causes of unclaimed money.

6. A Person has changed his name

- A person has changed his name for several reasons, which are as follows.

A. changed his name due to the marriage

- In Indian rituals, if a girl has married, she will need to change her surname. This can be the root cause of unclaimed money.

B. Changed his name due to other reasons

- A person needs to change his name for several reasons: legal reasons, personal reasons, safety and security, adoption, etc. This can be root cause for unclaimed money.

7. Jailed for crime

- A person gets sentenced to jail after committing a crime like murder, fraud, drug offense, white collar crimes, etc. This can be root cause for unclaimed money.

8. Person is Missing

- A person is missing from his place. We see many news stories where a person does not reach home after leaving in the morning. This can be the root cause of unclaimed money.

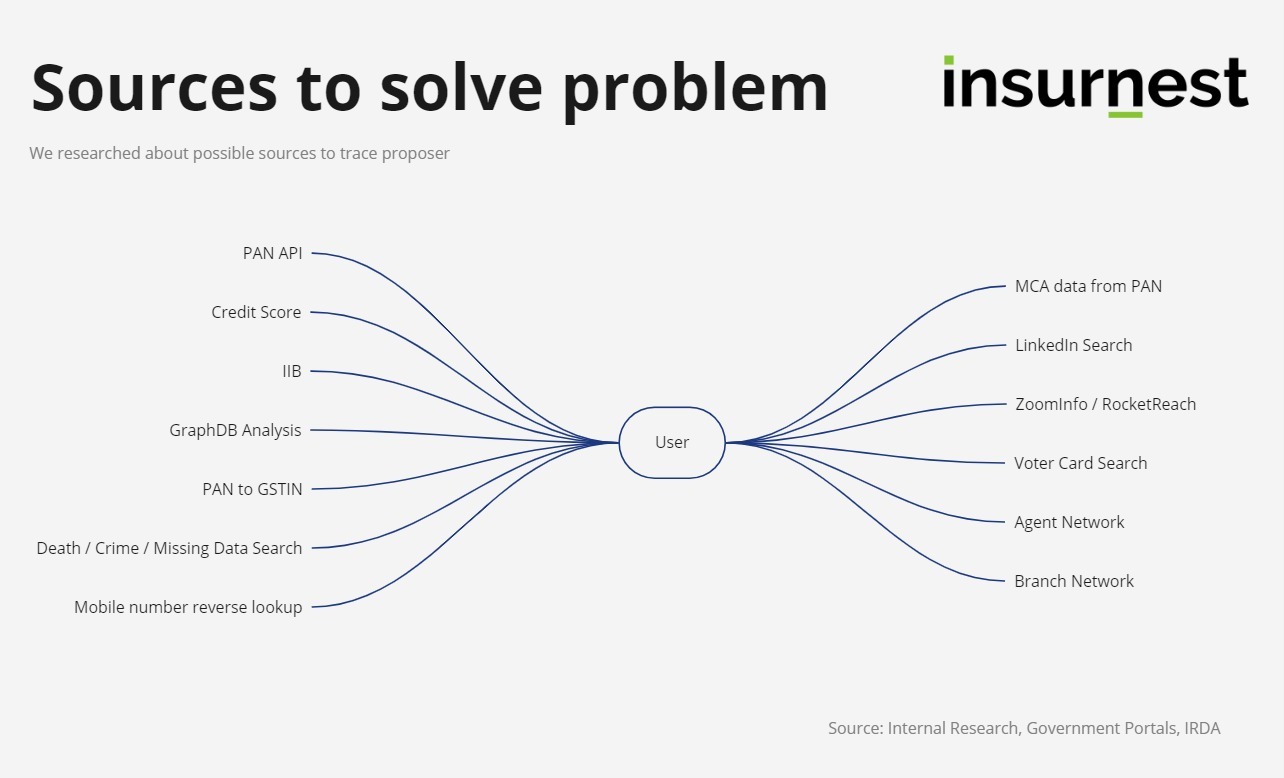

Sources To Trace The Unclaimed Money?

- Insurance companies can track a person in the skip tracing using the following sources.

1. PAN API (Permanent Account Number Application Programming Interface)

- "PAN API" refers to an Application Programming Interface that enables database access connected to government-issued Permanent Account Numbers (PAN). PAN information, linked to several official documents and financial activities, may be accessed via PAN API in the context of skip tracing. Insurance firms may use PAN API to watch policyholder financial activity, confirm policyholder identification, and get up-to-date contact details. By utilizing PAN API, insurance companies may improve the efficiency of skip tracing and the precision of finding people connected to insurance policies. By using this method, insurance companies can solve an unclaimed money problem.

2. Credit Score

- Credit scoring companies keep extensive databases with information on people's credit histories, including their borrowing and repayment patterns. Credit ratings are useful tools in skip tracing since they may be used to identify people who might not have paid their insurance or loan payments on time. Insurance firms can use credit ratings to evaluate policyholders' financial standing and recent activity, which aids in locating any skip tracers or contacts. To effectively trace people connected to insurance policies, insurers can discover behavior patterns and prioritize skip-tracing tactics by analyzing credit score data. By using this method, insurance companies can solve an unclaimed money problem.

3. IB (Insurance Information Bureau)

- Insurance industry groups or regulatory bodies manage the Insurance Information Bureau (IIB), a centralized database of insurance-related information. Insurance firms use the IIB as a vital source of information when trying to find policyholders or beneficiaries through skip-tracing procedures. Policy specifics, claim histories, contact details, and other pertinent information about insurance plans are all contained in the IIB database. To track policy status, obtain current policyholder information, and spot inconsistencies or changes in policyholder data; insurance firms can submit queries to the IIB. Using the IIB's resources, insurance companies may enhance their capacity to find people connected to insurance policies and speed skip-tracing initiatives. By using this method, insurance companies can solve an unclaimed money problem.

4. GraphDB Analysis

- GraphDB analysis is the process of examining connections and interconnections between different data points by using graph databases. This technique may be used in skip tracing to map out relationships between people, such as friends, relatives, or business associates, to identify possible leads for finding a person. Insurance firms can find vital information to help with skip tracing by looking at how data, including social networks, financial activities, and other pertinent information, are related. By using this method, insurance companies can solve an unclaimed money problem.

5. PAN to GSTIN (Goods and Services Tax Identification Number)

- Linking Goods and Services Tax Identification Numbers (GSTIN) with Permanent Account Numbers (PAN) might yield important information for skip tracing. Businesses enrolled in the Goods and Services Tax (GST) system are given a unique identification number called a GSTIN. Insurance firms may track down individuals linked to business enterprises by connecting PAN to GSTIN. This enables them to investigate other options for tracking down the individual, including company addresses, contacts, and transaction data. By using this method, insurance companies can solve an unclaimed money problem.

6. Death / Crime / Missing Data Search

- Searches in databases holding information on crimes, fatalities, or missing people might yield vital details for skip tracing. Insurance firms may use these databases to find out whether the individual they are looking for has been engaged in any events or if there are any court cases or law enforcement cases related to them. By doing these searches, insurers may better evaluate the risks and difficulties associated with tracking down the individual and adjust their skip-tracing tactics appropriately. By using this method, insurance companies can solve the unclaimed money problem.

7. MCA (Ministry of Corporate Affairs) data from PAN

- PAN access to Ministry of Corporate Affairs (MCA) data can provide insight into people's participation in corporate enterprises. Insurance firms can determine who is a director, partner, or investor in a registered company by examining MCA data. This data facilitates skip-tracing by enabling insurers to track individuals through corporate ties, including contact information, firm addresses, and court filings. By using this method, insurance companies can solve the unclaimed money problem.

8. LinkedIn Search

- Utilizing business networking sites such as LinkedIn may be an effective skip-tracing tactic. Insurance firms may use LinkedIn to look up people and learn about their work history, professional contacts, and present location. LinkedIn profiles frequently provide up-to-date contact information, educational background, and employment history, which can help insurers identify the insured individual. By using this method, insurance companies can solve the unclaimed money problem.

9. ZoomInfo / RocketReach

- Businesses may access large databases of professional profiles and business relationships through platforms like ZoomInfo and RocketReach. By using these platforms to search for people based on their names, job titles, or firm connections, insurance companies may use them for skip tracing. These sites frequently provide contact details, such as phone numbers and email addresses, that help insurers contact the individual they're looking for. By using this method,insurance companies can solve an unclaimed money problem.

10. Voter Card Search

- Voter card databases kept up to date by election officials can be excellent resources for skip-tracking data. Insurance companies may search voter registration records to find current residences, polling place specifics, and other pertinent data on individuals registered to vote.By cross-referencing this data with information from different sources, insurers can improve their search for the individual linked to an insurance policy. By using this method, insurers can solve an unclaimed money problem.

11. Agent Network

- Insurance firms typically have extensive networks of agents who deal with beneficiaries and policyholders. These agents may be useful in skip tracing since they can use their contacts and local expertise to find people. Through their agent network, insurers can get data, pursue leads, and organize attempts to locate the individual linked to an insurance policy. By using this method, insurance companies can solve the unclaimed money problem.

12. Branch Network

Like the agent network, the insurance company branch network is a useful skip-tracking tool. Insurance offices spread throughout different areas or towns might offer local assistance in identifying people. Branch employees can visit addresses, ask questions, work with local authorities to get information, and efficiently assist with skip-tracing. By using this method,insurance companies can solve an unclaimed money problem.

13. Reverse number lookup

- Services such as Truecaller have data for lots of data across the mobile. Such services also have the contact details of other people who have previously saved the number. Such services can also be leveraged to reach people. By using this method, insurance companies can solve an unclaimed money problem.

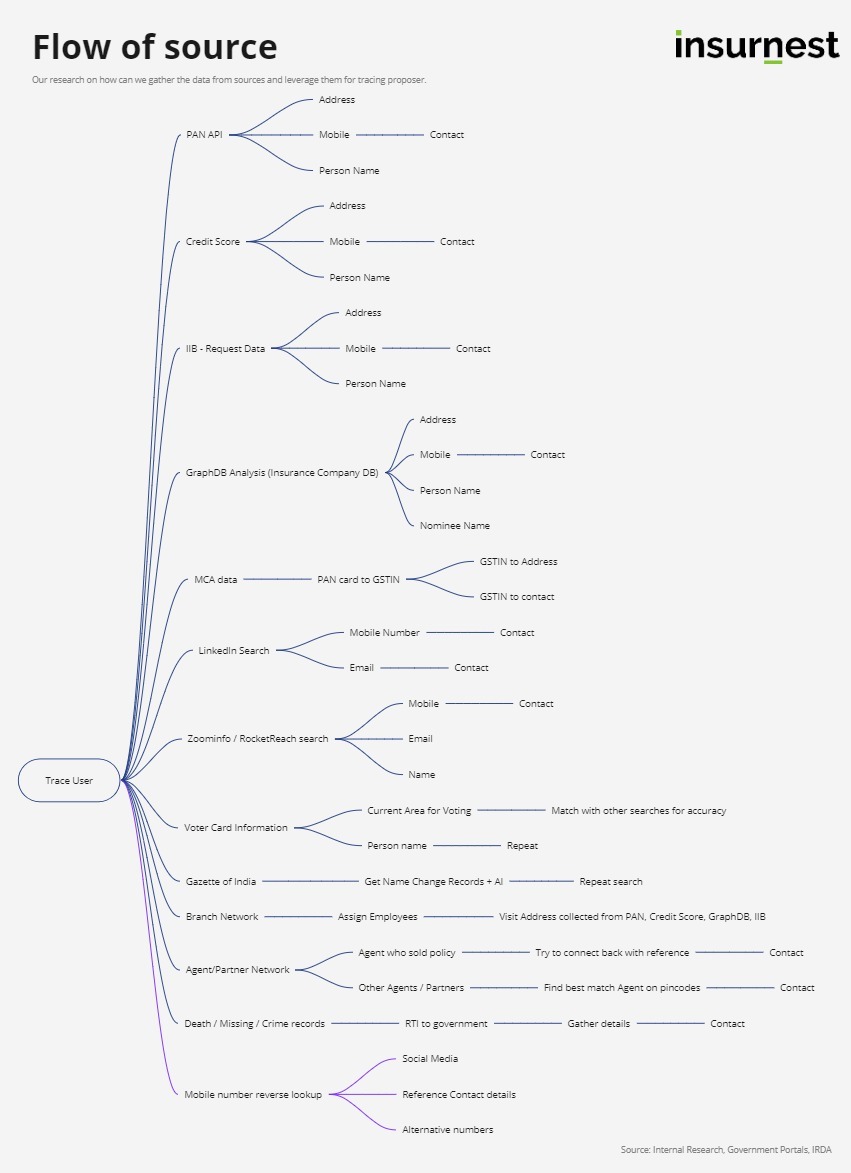

Flow of source

- Each source can reveal some details, which can later be used to solve the puzzle. A technology-driven approach always pays off in the long run.

Conclusion

-

When we come to the end of our investigation into the world of skip tracing, it is clear that this complex procedure is more than just a tool it is the insurance industry's lifeblood. When policyholders become elusive, skip tracing becomes a ray of hope, helping insurers navigate the maze of unknowns. Skip tracing is the compass that helps insurers navigate the difficulties of finding people who have fallen through the cracks, from the ordinary to the mysterious disappearances.

-

Skip tracing will change along with the insurance sector, adopting new technology, moral standards, cooperative alliances, and ways to stay ahead of the always shifting terrain. Skip tracing continues to prove its essential position as the defender of insurance integrity with every obstacle surmounted and policyholder found, guaranteeing that no policyholder is lost in the fog of doubt.

Frequently Asked Questions

What is the unclaimed money problem in insurance?

The unclaimed money problem refers to insurance benefits, refunds, and payouts that remain unclaimed by beneficiaries due to lack of awareness, outdated contact information, or complex claim processes.

How can technology help solve the unclaimed money problem?

Technology can help through automated beneficiary tracking, digital communication systems, AI-powered matching algorithms, blockchain for transparent records, and proactive notification systems.

What are the main causes of unclaimed insurance money?

Main causes include outdated beneficiary information, lack of awareness about benefits, complex claim procedures, poor communication, and insufficient follow-up by insurance companies.

How can insurers reduce unclaimed money issues?

Insurers can reduce issues through better record keeping, proactive beneficiary communication, simplified claim processes, digital tracking systems, and regular policy holder engagement programs.