The Role of Blockchain in Reinsurance: Streamlining Processes and Mitigating Risk Introduction

Introduction

- Reinsurance is an important component of the insurance industry, protecting insurers from huge and catastrophic losses. This procedure, however, is complex, requiring several participants and substantial documentation. However, the introduction of blockchain in reinsurance environment is undergoing a tremendous transformation. In this blog article, we'll look at the influence of blockchain on reinsurance, emphasizing its role in streamlining processes and decreasing risk.

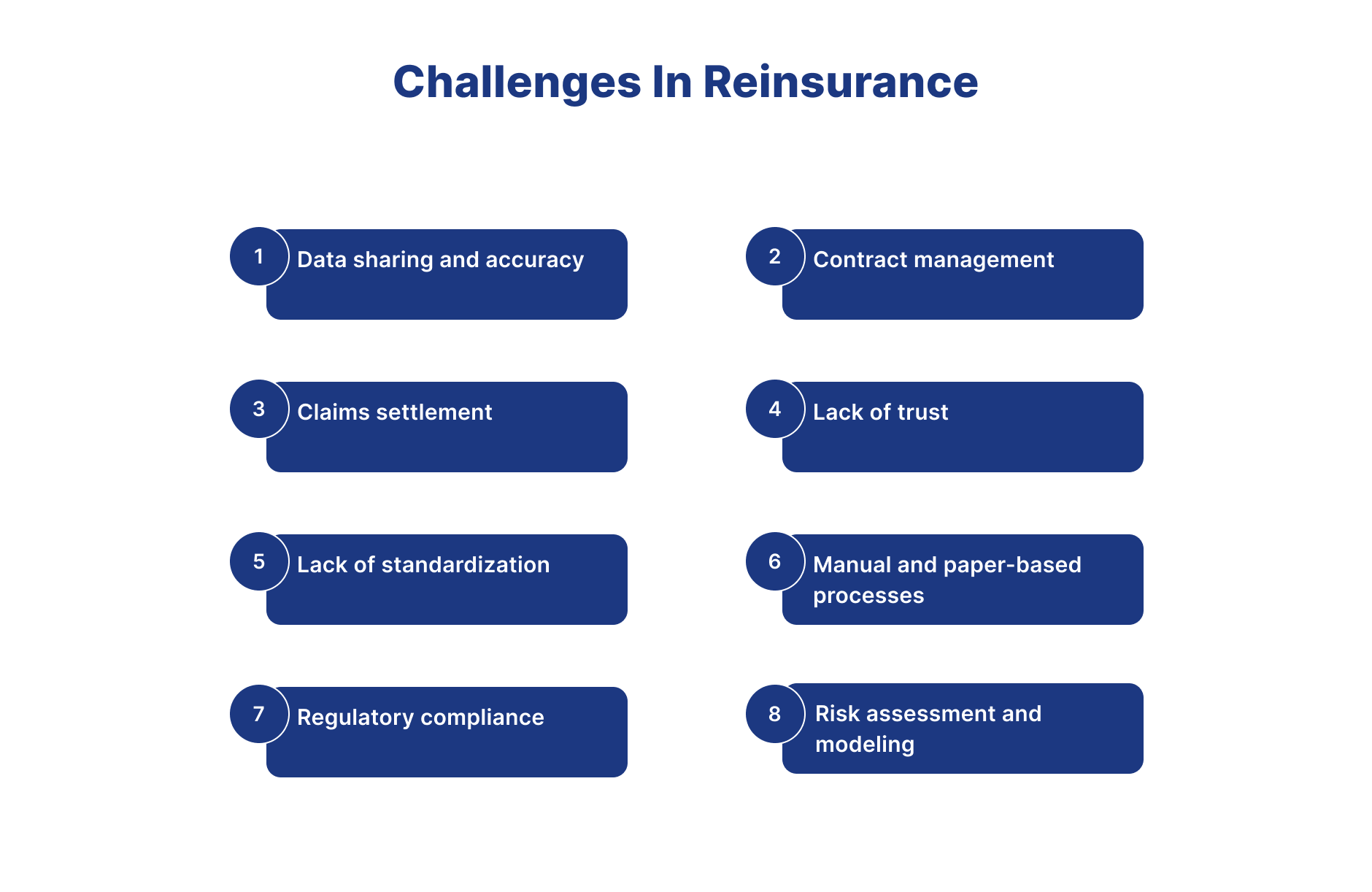

Challenges in Reinsurance :-

- The reinsurance process involves numerous parties, such as the primary insurer, reinsurer, brokers, and policyholders. This complexity poses several challenges:

1. Data sharing and accuracy

- Reinsurance involves the exchange of extensive data among different entities. Ensuring the accuracy and transparency of this data can be quite burdensome and time-consuming.

2. Contract management

- In the world of insurance, the creation and management of reinsurance contracts are no small feat. It's a process that entails a lot of paperwork, detailed manual reconciliation, and, unfortunately, hefty administrative costs. Every step requires a mountain of paperwork, from drafting the initial terms to finalizing the agreements. And when it comes to ensuring accuracy and compliance, manual reconciliation becomes a time-consuming necessity. This paperwork and manual labor add up, driving up administrative costs for insurers and reinsurers alike. It's a cumbersome process that's ripe for improvement.

3. Claims settlement

- Settling claims in the reinsurance sector frequently entails sophisticated calculations, discussions, and reconciliations, resulting in delays and disagreements.

4. Lack of trust

- In reinsurance, trust, and openness are critical for all parties involved. However, because this sector operates across several regions and companies, trust can occasionally be tested, resulting in conflicts and disputes.

5. Lack of standardization

- In the reinsurance sector, there is an issue with inconsistent procedures and data formats. This makes it difficult for various organizations to collaborate effectively and slows down how efficiently things are completed. Furthermore, because everyone does not use the same language and formats for their data, it is difficult to share and analyze information accurately.

6. Manual and paper-based processes

- In today's reinsurance sector, a large number of operations rely significantly on manual and paper-based procedures. This dependency frequently leads to inefficiencies, delays, and an increased risk of blunders. Manually inputting data and organizing documents is a time-consuming and error-prone operation.

7. Regulatory compliance

- The reinsurance sector must follow many rules and regulations imposed by regulators. Meeting these standards might be difficult since it takes significant time and resources to complete the appropriate paperwork and administrative duties.

8. Risk assessment and modeling

- In the reinsurance industry, understanding the risks is critical. However, traditional methods of accomplishing this, which frequently rely on previous data and personal judgments, can be hit-or-miss. This is where blockchain comes in. It provides a method for making risk assessment more trustworthy by maintaining a clear and unchanging record of information. Furthermore, it allows us to include current data from reliable sources, which is beneficial.

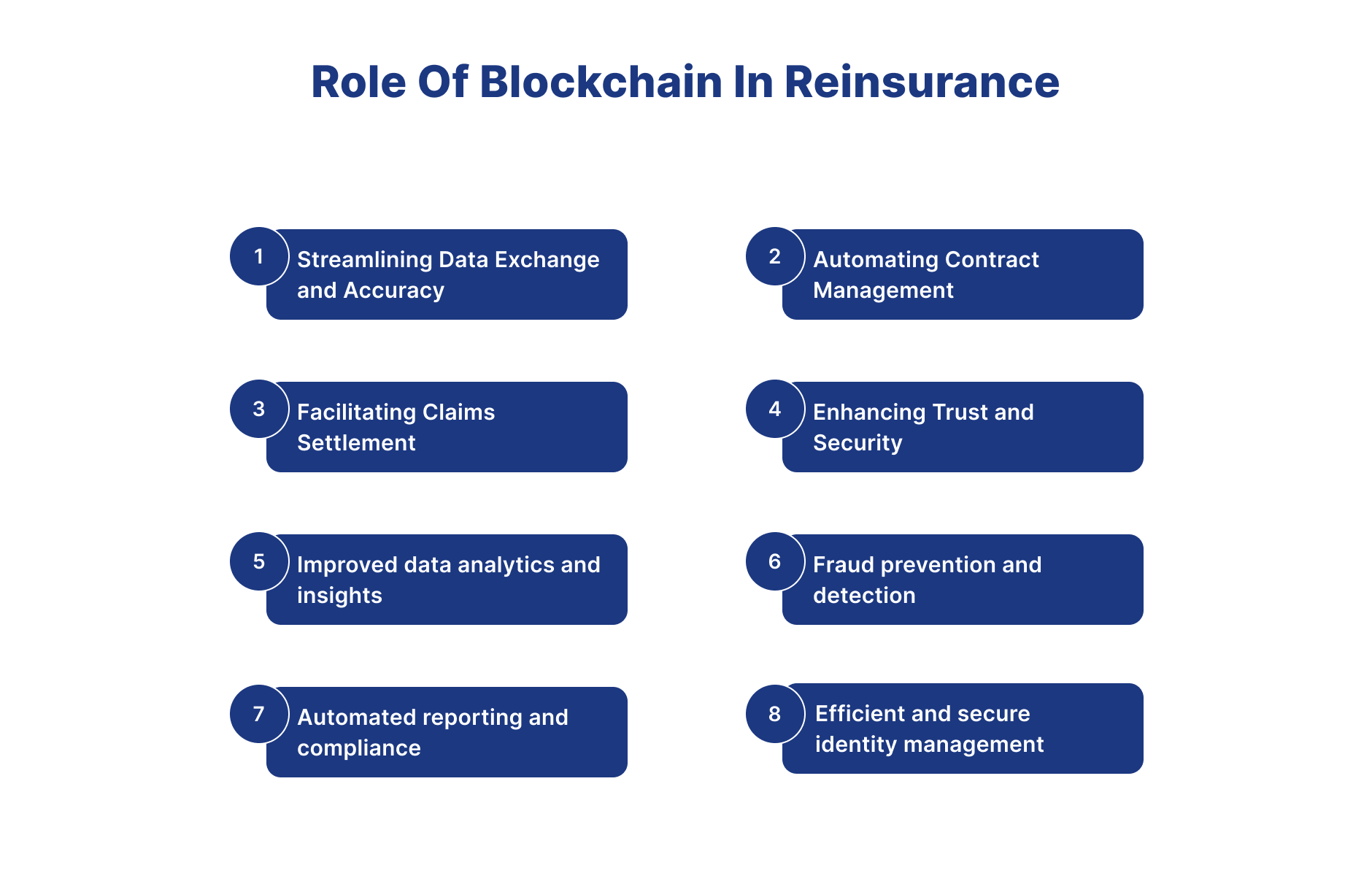

Role of Blockchain in Reinsurance

Blockchain technology creates a decentralised, secure, and transparent platform, successfully addressing the challenges faced by the reinsurance market.

1. Streamlining Data Exchange and Accuracy

- A distributed ledger system, enabled by blockchain technology, enables a safe and seamless data flow. This implies that everyone involved in a reinsurance transaction can view and verify the same information, which fosters confidence and openness. With distributed ledger technology, there is only one trustworthy version of the data, eliminating the time-consuming process of reconciling multiple records. As a result, exchanging and validating data becomes more efficient, lowering costs and the possibility of errors. In this way, blockchain in reinsurance can streamline data exchange and accuracy.

2. Automating Contract Management

- Intelligent contracts are smart little entities that function similarly to contracts but are stored on the blockchain. They handle the heavy lifting for reinsurance contracts, making life easier. Essentially, they control the reinsurance deal's regulations and are intelligent enough to manage payments and make things happen when specific circumstances are satisfied. It's like having a super organized assistant who handles all the tedious paperwork, which means less fuss, no need to double-check contracts by hand, and everything is completed correctly and on time. In this way, blockchain in reinsurance can automate contract management.

3. Facilitating Claims Settlement

- Blockchain technology can change the way claims are handled in the reinsurance sector. Claims may be handled more quickly by putting all necessary information in a common ledger, which reduces paperwork and speeds up the process. Furthermore, blockchain's immutable nature and openness make it more difficult for false claims to pass through, promoting higher confidence among all interested parties and minimizing conflicts, thus accelerating settlements. In this way, blockchain in reinsurance can facilitate claim settlement.

4. Enhancing Trust and Security

- Blockchain's decentralised nature makes important contributions to developing confidence in the reinsurance industry. Everyone engaged benefits from its distributed ledger technology, which provides transparent and secure records, increasing faith in the information's reliability and honesty. Furthermore, blockchain's encryption and consensus processes dramatically improve its security, reducing the likelihood of unauthorized access and fraudulent actions. In this way, blockchain in reinsurance can enhance trust and security.

5. Improved data analytics and insights

- Blockchain technology enables the secure and unchanging collection and storage of massive data. This data is important for in-depth research and insights, providing reinsurance businesses with a deeper perspective of risks, claim trends, and market developments. With these insights, they may make more accurate judgments when insuring policies and improve their approaches to risk management. In this way, blockchain in reinsurance can improve data analytics and insights.

6. Fraud prevention and detection

- Blockchain in reinsurance is extremely valuable because of its transparency and immutability. It's like a powerful anti-fraud tool! See, with this distributed ledger, every transaction, and record is permanent and tamperproof. This implies that fraudsters cannot manipulate the data, making it far more difficult for them to carry out any dodgy transactions. So, anytime there is a suspicious claim or financial activity, we can detect it quickly, making the entire reinsurance market far more trustworthy. In this way, blockchain in reinsurance can detect fraud and prevent it.

7. Automated reporting and compliance

- Blockchain in reinsurance enables the automation of reporting and compliance procedures in the market. Maintaining a comprehensive and easily auditable log of every transaction and piece of data simplifies regulatory reporting duties, reducing administrative burdens and increasing transparency. In this way, blockchain in reinsurance can automate reporting and compliance.

8. Efficient and secure identity management

- Blockchain technology offers a viable solution for improving identity management in the reinsurance industry. By utilizing blockchain, people and organizations have better control over their personal information and credentials, lowering The likelihood of identity theft and data breaches. This decentralized identity management style can improve onboarding procedures and KYC (Know Your Customer) processes in the reinsurance business, increasing operational efficiency. In this way, blockchain in reinsurance can secure identity management.

Conclusion

- In summary, blockchain in reinsurance is having a significant influence on the market. It is altering how things function by introducing new ways to manage identities, reducingthe dangers of identity theft and data breaches, improving the efficiency of critical operations such as onboarding and KYC. Because it is decentralized, it provides users greater control over their personal information and makes activities function more smoothly. As the reinsurance sector evolves, blockchain will likely become increasingly significant, delivering progress while making the entire system safer and stronger for everyone involved.

Frequently Asked Questions

How does blockchain transform reinsurance operations?

Blockchain transforms reinsurance through smart contracts for automatic settlements, transparent risk sharing, immutable transaction records, streamlined claims processing, and enhanced trust between cedents and reinsurers.

What benefits does blockchain provide for reinsurance contracts?

Benefits include automated contract execution, reduced settlement times, transparent terms and conditions, immutable audit trails, lower administrative costs, and elimination of disputes through smart contract automation.

How does blockchain improve reinsurance data sharing?

Blockchain enables secure, transparent data sharing between parties, creates single source of truth for claims data, facilitates real-time information exchange, and maintains data integrity across the reinsurance chain.

What challenges does blockchain address in reinsurance?

Blockchain addresses challenges including manual contract processing, settlement delays, data reconciliation issues, lack of transparency, trust concerns, and complex multi-party transaction coordination.