How Blockchain Is Redefining Insurance Data Security in 2025

Introduction

- In today's ever-changing insurance industry, the advent of blockchain technology marks a transition to a more streamlined, transparent, and secure future. However, the path to adopting blockchain is not without its challenges. Through this in-depth investigation, we'll identify the challenges insurance firms face before integrating blockchain, look into how blockchain adoption transforms their operations, and envision how the sector will grow with blockchain as its foundation.

Understanding Blockchain Technology in the Insurance Sector

What is Blockchain?

- Blockchain technology is fundamentally a system for recording information in a way that makes it difficult or impossible to change, hack, or cheat the system. A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant's ledger. This decentralized and transparent nature of blockchain makes it highly secure and very useful for various applications, including in the insurance industry.

Private and Public Blockchains with Examples

-

Blockchains can be categorized into two main types: private (or permissioned) and public (or permissionless) blockchains.

-

Public Blockchains: A public blockchain is one where anyone can join and participate in the process of block verification. Transactions on a public blockchain are visible to all its users, and anyone can participate in the consensus process. The most famous example of a public blockchain is Bitcoin. In the context of insurance, a public blockchain could be used to transparently and securely manage and record transactions and claims between multiple parties. Some of such public blockchain platforms are Etherium, Ripple, Solana etc.

-

Private Blockchains: In contrast, a private blockchain is restricted and one cannot join it unless invited by the network administrators. Private blockchains are often faster and more efficient than public blockchains because they are smaller and there are fewer participants to reach a consensus. For example, a group of insurance companies could establish a private blockchain to efficiently handle inter-company claims and reduce fraud. A real-world example is B3i, an initiative by major insurers to explore the potential of blockchain to speed up data transfer and claims processing among insurers. Some of such private blockchain platforms are Hyperledger Fabric, R3 Corda, Quorum etc.

What is a Smart Contract?

- A smart contract is a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network. Smart contracts permit trusted transactions and agreements to be carried out among disparate, anonymous parties without the need for a central authority, legal system, or external enforcement mechanism. They render transactions traceable, transparent, and irreversible.

Example of Smart Contract in Insurance

- In the insurance industry, smart contracts can be used to automate the claims process, which traditionally is time-consuming and can be prone to errors. For example, consider a travel insurance policy that compensates travelers automatically if their flight is delayed more than a certain amount of time. The smart contract could be connected to external data sources that monitor flight statuses. If a delayed flight is detected, the smart contract automatically triggers a payment to the policyholder, without any manual intervention required by the insurance company. This not only speeds up the processing of claims but also enhances customer satisfaction by ensuring timely payouts.

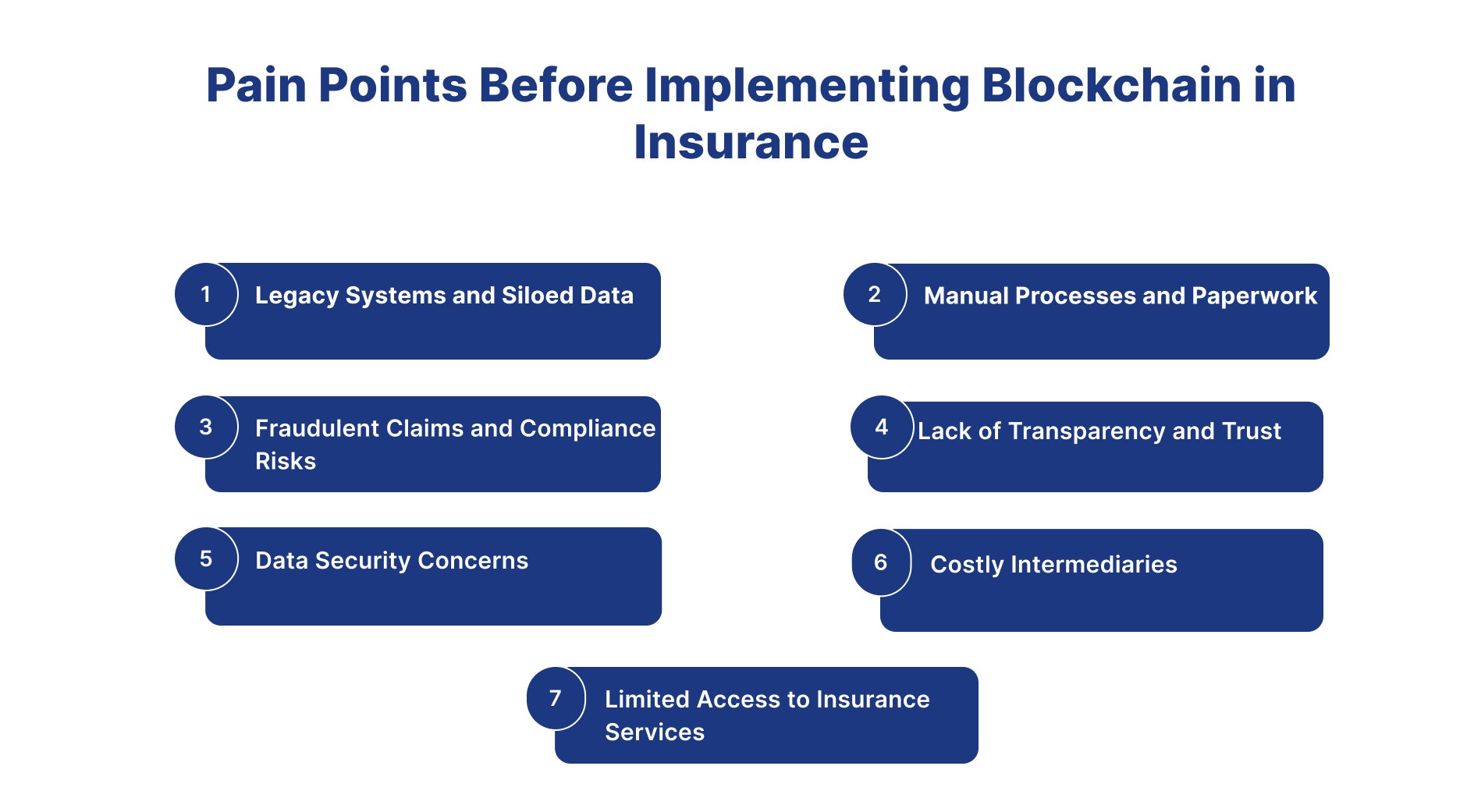

Pain Points Before Implementing Blockchain in Insurance

- Before the widespread use of blockchain in the insurance sector, insurance businesses faced several issues that impeded operational efficiency and inhibited innovation. Some of the main pain areas they experienced were:

1. Legacy Systems and Siloed Data

- Many insurance businesses were stuck with antiquated, lumbering systems that couldn't keep up with the torrent of data. You'd have these discrete pockets of knowledge distributed around the organization, making it difficult to handle things properly. This structure severely inhibited departmental interaction and collaboration. It was as if everyone was operating in their little bubble, unable to exchange or obtain the required information.

2. Manual Processes and Paperwork

- Previously, insurance operations depended heavily on physical labor and copious paperwork. This meant that things took forever to complete, were much more expensive due to the time and effort necessary, and made it easier for mistakes and unscrupulous businesses to sneak through the cracks.

3. Fraudulent Claims and Compliance Risks

- Fraudulent claims constituted a significant challenge for the insurance industry, generating financial losses and harming insurers' reputations. Furthermore, satisfying regulatory standards such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations increased the heavy compliance effort and operating costs.

4. Lack of Transparency and Trust:

- There was a noticeable lack of openness and confidence in many insurance transactions. This frequently led to arguments, delays, and frustration among policyholders. The lack of transparency in conventional insurance procedures fueled mistrust, making it difficult to connect and retain clients successfully.

5. Data Security Concerns

- Historically, traditional insurance systems had a significant challenge: they were vulnerable to cyberattacks and data breaches, placing sensitive consumer information in considerable danger. Because all data was housed centrally, these systems were an ideal target for hackers. This exposed insurers to potential legal action and financial losses and harmed their reputation in the eyes of customers.

6. Costly Intermediaries

- Insurance transactions may be tricky. due to the number of intermediaries involved, including brokers, agents, and third-party service providers. Each of these stakeholders just adds to the overall complexity and expense of the process. With so many hands in the pot, it's no surprise that premiums rise, administrative costs skyrocket, and processing times take forever. It's a headache for insurance companies and consumers, and it detracts from the very purpose of insurance, which is to make things easier and safer for everyone involved.

7. Limited Access to Insurance Services

- Obtaining insurance services has been difficult in many parts of the world due to distance from significant areas, inadequate infrastructure, and economic barriers. Traditional insurance procedures relied mainly on actual branch offices and in-person interactions, which constituted a substantial barrier for marginalized people seeking coverage and protecting themselves from numerous threats.

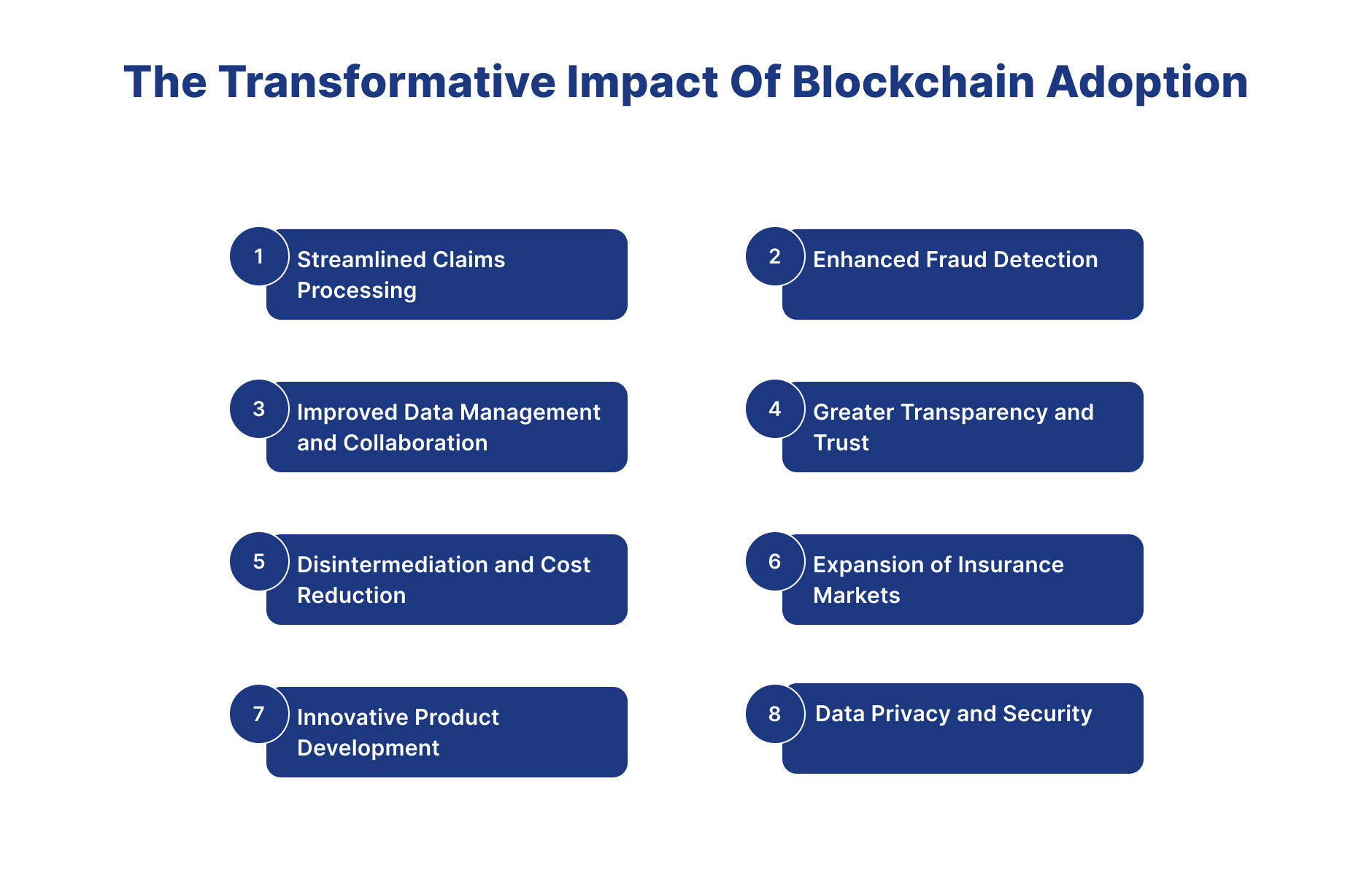

The Transformative Impact of Blockchain Adoption

- Now that blockchain technology has arrived, insurance businesses are on the verge of overcoming these challenges and opening up new opportunities for growth and creativity. Let's look at how adopting blockchain is transforming the insurance landscape:

1. Streamlined Claims Processing

- Thanks to blockchain-powered intelligent contracts, insurance firms can now automate and streamline the process of resolving claims, requiring less time and resources to resolve them. These smart contracts are meant to automatically execute claims based on previously defined criteria, making the entire process quicker and more efficient. This not only speeds up claim settlement but also helps to reduce conflicts, resulting in happy consumers. In this way, blockchain in the insurance sector will streamline claim processing.

2. Enhanced Fraud Detection

- Blockchain's visible and unchangeable record is a strong barrier against manipulation and fraud. With transactions securely recorded on a decentralized network, insurers may create a dependable and readily verifiable record of all insurance-related activities. This enhances security and enables more effective detection and prevention of fraudulent activities in the insurance sector. In this way blockchain in insurance sector will enhance fraud detection.

3. Improved Data Management and Collaboration

- Blockchain technology makes data management more safe and effective by offering a decentralized and transparent platform for storing and exchanging information. Blockchain fosters cooperation among insurers, reinsurers, and other stakeholders by breaking down data silos and providing real-time access to information, resulting in better-informed decision-making and increased operational efficiency. In this way, blockchain in insurance sector will improve data management and collaboration.

4. Greater Transparency and Trust

- Blockchain increases transparency and confidence in insurance transactions by creating a verifiable and tamper-proof record of transactions. Policyholders may view and check their insurance policies and claims data in real time, increasing trust and confidence in the insurance business. This way, blockchain in insurance companies can get greater transparency and trust.

5. Disintermediation and Cost Reduction

- Blockchain decreases the costs of traditional insurance operations by removing intermediaries and automating procedures. Smart contracts automate policy issuance, premium payments, and claims processing, lowering administrative costs and enhancing cost efficiency for insurers. Furthermore, the decentralisation of blockchain reduces the requirement for third-party verification, thus lowering operating expenses.

6. Expansion of Insurance Markets:

- Underserved people and emerging countries benefit from blockchain technology, which makes insurance more accessible. Decentralized insurance platforms and peer-to-peer (P2P) insurance models use blockchain technology to link insurers directly with clients, cutting out traditional distribution channels and geographical obstacles. This growth of insurance markets boosts market penetration and improves financial inclusion and resilience in previously neglected areas. In this way blockchain in insurance industry will help insurance companies to expand their markets.

7. Innovative Product Development

- Blockchain enables the development of novel insurance products and services previously impossible or prohibitive. Parametric insurance, for example, uses blockchain smart contracts to automate payouts depending on predetermined parameters, such as weather occurrences or IoT sensor data. The tokenization of insurance assets provides new opportunities for fractional ownership and investment, allowing insurers to create unique risk-sharing systems and revenue streams. This way, blockchain in insurance sector will help insurance companies make innovative products.

8. Data Privacy and Security

- Blockchain's cryptography algorithms and decentralized design improve data privacy and security in insurance transactions. Personal and sensitive information saved on the blockchain is encrypted and only available to authorized individuals,lowers the risk of data breaches and unlawful Furthermore, blockchain's consensus methods ensure that data cannot be edited or tampered with once recorded, resulting in excellent data integrity and fraud prevention. In this way blockchain in insurance sector will enhance data privacy and security.

Conclusion

-

Implementing blockchain in insurance business marks a paradigm change beyond simple operational improvements. Blockchain is transforming the underlying dynamics of the insurance industry by solving long-standing difficulties and opening up new potential for innovation, efficiency, and trust. Blockchain implementation provides many revolutionary advantages for insurers, policyholders, and stakeholders, including improving data administration and increasing transparency, cost savings, expanded market access, and regulatory compliance.

-

In the future, insurance will be more efficient, transparent, and resilient, thanks to blockchain technology. Insurers who embrace blockchain technology and leverage its revolutionary power will gain a competitive advantage in the digital economy while contributing to a more inclusive, trustworthy, and sustainable insurance market for years. As we engage on this road of blockchain-driven transformation, the possibilities and opportunities for creativity are unlimited.

-

In conclusion, blockchain and smart contracts offer transformative potential for the insurance industry. They can increase transparency, speed up claims processes, and reduce costs and fraud. As these technologies continue to evolve, their impact on the industry is expected to grow, reshaping how insurers, policyholders, and service providers interact.

Frequently Asked Questions

What is blockchain technology in insurance?

Blockchain in insurance is a distributed ledger technology that provides secure, transparent, and immutable record-keeping for policies, claims, and transactions, making it difficult to change, hack, or cheat the system.

How do smart contracts work in insurance?

Smart contracts are self-executing contracts with terms written directly into code. In insurance, they can automate claims processing - for example, automatically paying travel insurance claims when flight delays are detected from external data sources.

What are the main benefits of blockchain for insurers?

Key benefits include enhanced fraud detection through immutable records, streamlined claims processing via smart contracts, improved data security, reduced operational costs by eliminating intermediaries, and greater transparency building customer trust.

What challenges do insurers face when implementing blockchain?

Main challenges include integrating with legacy systems, ensuring regulatory compliance, addressing scalability concerns, managing the transition from manual processes, and establishing industry-wide adoption standards.