AI Solve Problems in Insurance: 5 Key Challenges Fixed by AI

Introduction

- Artificial Intelligence (AI) is a new hero in the fast-paced world of insurance. AI solve problems in insurance. the venerable industry struggles with issues like the intricate dance of fraud and the maze of regulatory compliance. Imagine a future in which fraud is detected early on a digital Sherlock Holmes, claims are handled at the speed of thought, and policies easily adjust to your needs. As AI sets off on a revolutionary path to transform the challenges facing the insurance business into possibilities, this is not the future; this is the here and now. in this blog we will explore Ai solve problems in insurance with unparalleled efficiency and security.

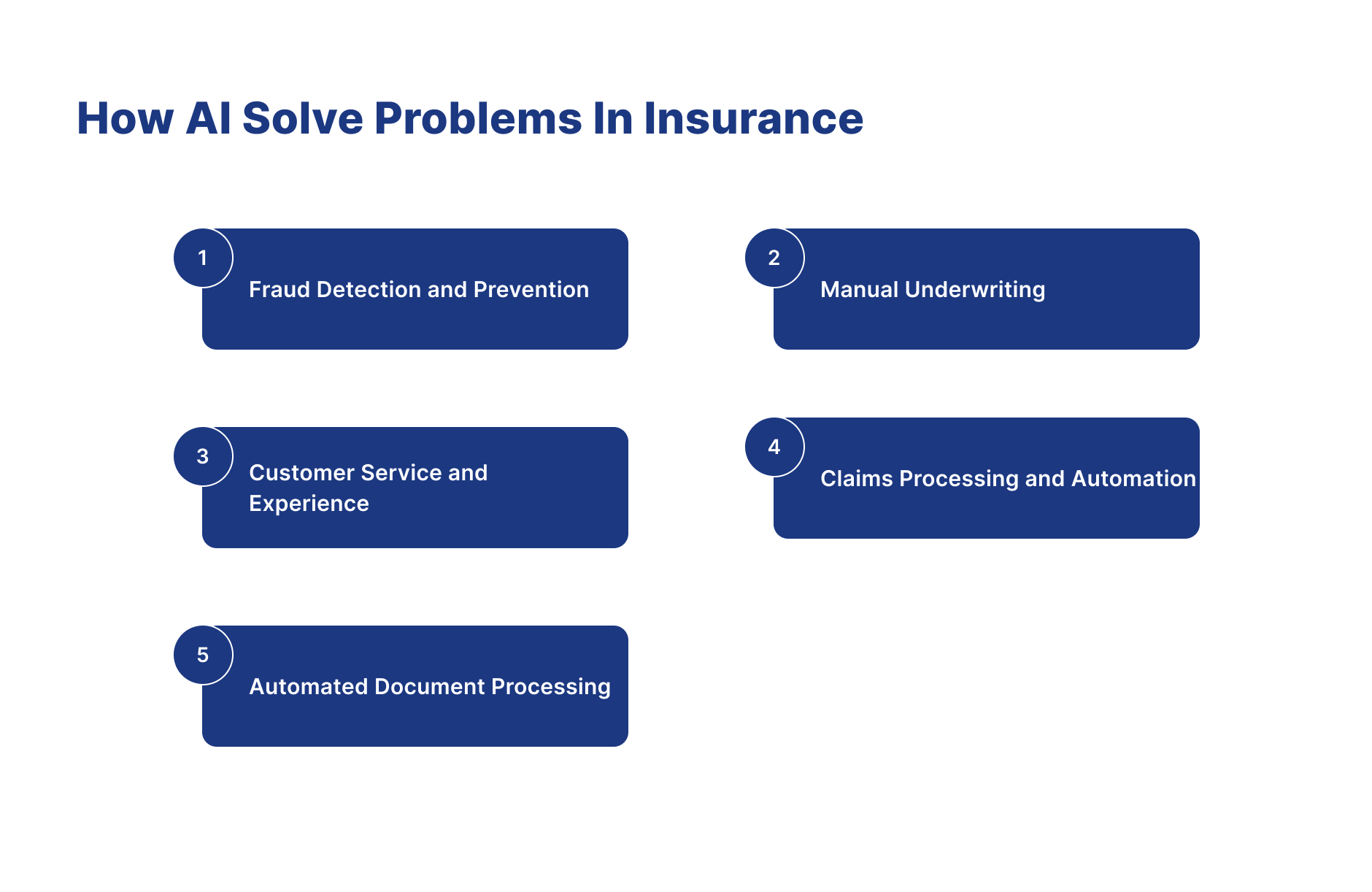

How AI solve problems in insurance

1.Fraud detection and prevention

-

In the pre-AI era insurance companies need to create a separate department where company need to hire the employee to detect the fraud. If the customer register the complaint about the fraud then employees will investigate it. With the human power insurance company can analyze the limited data and sometime there might be some mistake can be happen by employees. Employees can take too much time to investigate the fraud.

-

Large datasets may be analyzed by AI-driven systems, which can also spot trends that point to fraudulent activity. By using past data to identify patterns, machine learning algorithms can assist insurers in preventing and successfully addressing false claims. with the help of this way, Ai solve problems in insurance industry.

2.Manual Underwriting

-

In the traditional underwriting process insurance companies need to hire the employee for the underwriting process. In that employee will analyze the customer application and after that he will analyze that how much risk is involve if customer purchase the insurance policy and on the basis of that risk he will decide to sell the insurance policy or not to the customer.

-

Through the analysis of enormous volumes of data, such as client profiles, medical records, and other pertinent information, AI may automate underwriting operations. This guarantees a more accurate risk assessment and expedites the underwriting process, which results in better pricing and more customised plans. with the help of this way Ai solve problems in insurance industry.

3.Customer Service and Experience

- In the pre-AI era insurance company need to hire the employee to handle the customer quaries. Employees will firstly understand the quarry of the customer and on the basis of the product or service knowledge he will answer the quarry of the customer. When company hire new employee then they will need to give a training to that employee every time. This will costly and time consuming. Employees can not work continuously they need a break after sometime and because of this insurance companies can not provide a 24/7 customer services.

- Chatbots and virtual assistants driven by AI are revolutionising customer service in the insurance sector. These clever machines are capable of responding to standard questions, offering details on policies, and even helping with the claims procedure. This raises customer satisfaction while freeing up human agents to handle more intricate and subtle client interactions with the help of this way Ai solve problems in insurance industry.

4.Claims Processing and Automation

-

In the traditional claim process customer firstly customer need to give a claim application to the insurance company then insurance company will provide a employee who help customer in the claim processing. Employee will review the damage part and make a decision that the part is covered in the insurance policy or not and after that he will decide that whether to approve the claim or not.

-

AI expedites the claims processing process by automating repetitive processes and utilising picture recognition to assess damage. Faster claim settlement and better customer service are the outcomes of this.with the help of this way AI solve problems in insurance industry

5.Automated Document Processing

-

In the traditional document processing customer need to submit the document for the verification in the insurance company. Then employees will verify it by comparing customer data. This process will costly and time consuming and some times employees will make a mistake in the verification process because of this if customer is eligible for the insurance policy then he will not get the policy.

-

AI-powered systems have the ability to process documents automatically, extracting pertinent information and lowering the possibility of errors that come with manual data entering. This reduces the possibility of processing errors and improves operating efficiency.with the help of this way AI solve problems in insurance industry.

Conclusion

- In conclusion, the insurance sector stands to gain a great deal from the implementation of AI, including improved risk assessment, more intelligent fraud detection, individualised client care, and higher productivity. Artificial intelligence (AI) is a vital tool that insurers can use to remain ahead of the curve and preserve their competitive advantage as they navigate a world that is changing quickly. AI is positioned to play a major role in the insurance industry going forward thanks to its amazing capacity for learning and making predictions from massive volumes of data. Thus, let's embrace AI's disruptive potential and harness its power to create a better, more secure future for both the insurance sector and its clients.

How Insurnest will help you in solve problems in your insurance company

-

At Insurnest, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Insurnest's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What major insurance problems can AI solve effectively?

AI solves problems including slow claims processing, inaccurate risk assessment, fraud detection, manual underwriting, poor customer service, regulatory compliance, and operational inefficiencies across insurance operations.

How does AI address insurance industry inefficiencies?

AI addresses inefficiencies through process automation, data-driven decision making, predictive analytics, intelligent document processing, workflow optimization, and elimination of manual, repetitive tasks.

What cost reduction benefits does AI provide to insurers?

AI reduces costs through automated processing, reduced manual labor, faster claim settlements, improved fraud detection, better risk selection, operational efficiency gains, and optimized resource allocation.

How does AI improve insurance accuracy and decision-making?

AI improves accuracy through data analysis, pattern recognition, predictive modeling, consistent application of rules, elimination of human errors, and continuous learning from outcomes and feedback.