AI in Insurance Industry: 5 Proven Ways to Drive Efficiency

Introduction

- AI in insurance industry is a cutting-edge approach to optimize workflows, boost client satisfaction, and reduce risks. Artificial intelligence (AI) technology is changing the insurance business by automating underwriting procedures and identifying fraudulent claims. Insurance companies may leverage machine learning algorithms to handle claims more quickly, personalize insurance policies, and generate more accurate forecasts by analyzing large volumes of data.

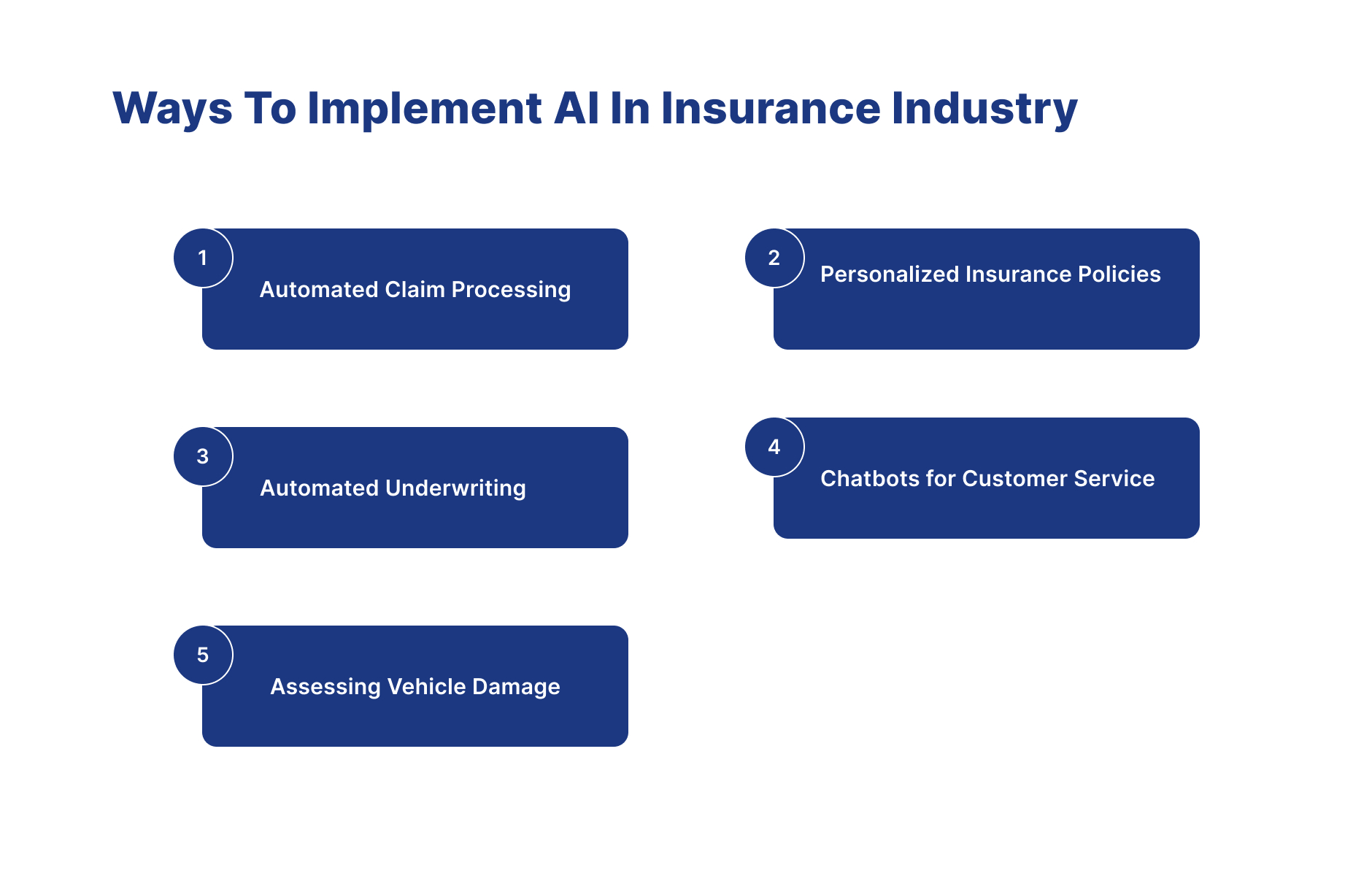

Ways to implement ai in insurance industry

1.Automated Claim processing

-

In the pre-AI era, insurance companies had an employee who could help customers to claim the insurance policy. In the claim process, the employee will review the customer's policy. After that, he will analyze the damage; based on that, the employee will decide whether to approve the claim. This traditional process of claiming is very time-consuming and costly.

-

However, after using AI in insurance industry, AI algorithms can extract pertinent data from various documents, including medical bills and accident reports, to streamline and automate the claim processing processes. A quicker and more accurate claims settlement procedure is ensured by this automation, which also saves time and lowers mistakes.

2.Personalized insurance policies

-

In the pre-AI era, insurance companies used the one-size-fits-all approach, offering all their customers the same type of insurance policy. They did not analyze the customer data to provide an insurance policy.

-

But after using AI in insurance industry, artificial intelligence (AI) enables insurers to customize the client experience By integrating data to create persona-based insurance plans. Insurers may use AI-driven chatbots to interact with clients, attend to their requirements, wants, and questions, and deliver pertinent policy information. Chatbots may be trained to identify the names and preferences of clients and assist them in selecting the best insurance according to their specific requirements and risk tolerance.

3.Automated Underwriting

- In the pre-AI era, insurance companies needed to use human power for the underwriting process. In the underwriting process, the employee will first assess the application. After that, he will identify the risk of the policy, and based on that, he will make a decision about policy.

- But after using AI in insurance industry, AI is bringing in a new age for underwriting By utilizing predictive analytics. Insurance companies may get a more sophisticated knowledge of risk variables by using machine learning algorithms, which can analyze large datasets quickly. This makes it possible to make more precise underwriting judgments, create customized pricing models, and quickly adjust to shifting market conditions.

4.Chatbots for Customer Service

-

In the pre-AI era, insurance companies needed employees to solve customer queries. The company needs to train their employees and give all the information about the product to give an accurate solution to the customer's query. In the traditional way, companies only provide replies to customers for a limited time, which will be very costly and time-consuming.

-

But after using AI in insurance industry, Chatbots with AI capabilities are now essential for FinTech client support. These smart devices answer common questions, assist users with transactions, and give prompt answers. Chatbots improve customer service efficiency by using machine learning and natural language processing to provide fast and accurate assistance. This frees up human agents to work on more difficult problems.

5.Assessing vehicle damage

-

In the pre-AI era, insurance companies had to hire employees to assess vehicle damage. The employee first visits the place where the vehicle is parked, and then he will review whether the insurance covers the damaged part of the vehicle. After checking all the information, he will make a decision whether to approve the insurance or not. It is an expensive and time-consuming procedure. Sometimes, there might be mistakes in approving the insurance policy.

-

But after using AI in insurance industry, Assessing the vehicle damage process becomes easier, less time-consuming, and less costly. Ai will use data on which it will train by the company, and on the basis of that, it will decide whether to approve the claim or not. In this process, the consumer needs to upload images of the accidental parts of the cars, and on the basis of those images, AI will decide whether to approve or not. In this process, there might be fewer chances of making mistakes in the assessment process.

Conclusion

-

In conclusion, the use of AI in the insurance industry presents various chances to boost client satisfaction, increase operational effectiveness, and reduce risks. AI technologies are changing how insurers do business, from automating underwriting procedures to allowing personalized consumer interactions through chatbots and virtual assistants. The insurance business has the potential to enhance forecast accuracy, personalize insurance offerings, and expedite claims processing through the utilization of machine learning algorithms.

-

Insurance businesses must use these technologies as AI develops to stay ahead of the curve and satisfy the shifting needs of the market. Adopting AI in insurance industry has the potential to increase customer focus, reduce costs, and enhance operations,all of which will contribute to a more competitive and long-lasting industry.

How Insurnest helps you to implement AI in your insurance company

-

At Insurnest, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Insurnest's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

How is AI driving innovation across the insurance industry?

AI drives innovation through intelligent automation, predictive modeling, personalized customer experiences, real-time risk monitoring, automated compliance, and new product development based on data insights.

What competitive advantages does AI provide to insurance companies?

AI provides advantages including faster time-to-market, improved operational efficiency, better risk selection, enhanced customer satisfaction, reduced costs, and ability to offer innovative products and services.

How does AI enable new insurance business models?

AI enables new models like usage-based insurance, on-demand coverage, peer-to-peer insurance, parametric products, and embedded insurance through real-time data processing and automated decision-making.

What is the future outlook for AI in the insurance industry?

The future includes more sophisticated AI models, increased automation, better predictive capabilities, enhanced customer experiences, regulatory clarity, and AI becoming integral to all insurance operations.