AI in Parametric Insurance: How Automation Reinvents Coverage

AI In Parametric Insurance : 1. Risk Assessment and Modeling, 2. Automated Triggers and Payouts, 3. Claims Processing Efficiency, 4. Enhanced Customer Experience

Introduction

-

Parametric insurance is a type of coverage that provides payouts when specific events occur. For instance, the policyholder receives compensation if rainfall drops below a predetermined threshold. Similarly, the policyholder is also covered if a flight is delayed beyond a set time.

-

There are many more such events that occur and create many more business opportunities and value for the insured.

-

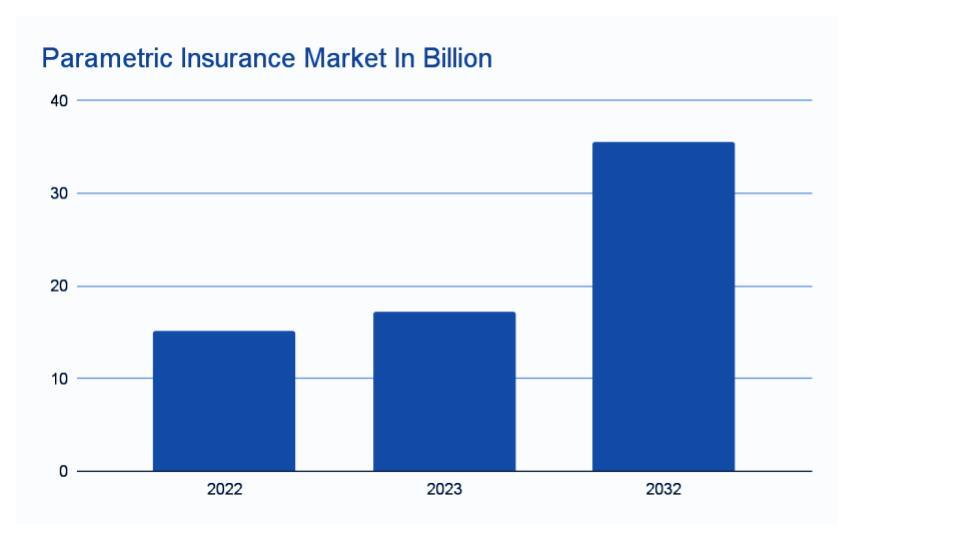

According to the sources, in 2022, the parametric insurance market was 15.2 billion. In 2023, it will become 17.2 billion; in 2032, it will become 35.6 billion. Because of this increasing number in the insurance market, insurance companies must improve their insurance sales, claims, etc., and use technologies to make their processes easy and faster. Insurance companies face some challenges.

-

Source: CMI

-

According to the CMI report, in 2022, the parametric insurance market was 15.2 billion; in 2023, it will become 17.2 billion, and it is expected that in 2023, it will become 35.6 billion.

-

Due to the increased demand for parametric insurance in the insurance sector, if insurance companies use traditional processes like manual data processing, regulatory compliance, claims, etc., they cannot scale the business and create a good business experience.

-

Imagine yourself about to set out on a much-anticipated adventure, standing in the busy terminal of an airport with excitement in the air. You've excitedly prepared every vacation detail, including your lodging and schedule, in anticipation of the exciting experiences. However, just as you get comfortable at the departure gate, a message that your aircraft has been delayed breaks through the noise.

-

A depressing sense of letdown quickly replaces the exhilaration of expectation. Your thoughts are buzzing with inquiries: Will you miss your subsequent flights? And what about that crucial business meeting you have scheduled when you arrive? And what about the priceless moments spent waiting for you to come with loved ones? The joy of your next voyage is threatened by the weight of uncertainty that is bearing down on you.

-

Parametric insurance provides a ray of optimism among the confusion and annoyance. You contact your insurance company with a renewed sense of resolve, your voice shaking with emotion as you describe the impact of your delayed trip on your plans and peace of mind.

-

In situations like these, when unanticipated setbacks and interruptions threaten to topple even the most well-laid plans, parametric insurance provides a lifeline. In contrast to conventional insurance, which sometimes necessitates drawn-out claims procedures and evaluations, parametric insurance offers prompt and reliable reimbursements based on predetermined triggers, such as aircraft delays lasting a specific amount of time. Imagine if, on such delays, the insurance company communicates with the customer, saying, you can apply for a claim for your flight delays. Such experiences can create great experiences for customers.

-

When uncertainty and time are important, such as during flight delays, this specific feature of parametric insurance becomes quite helpful. With parametric insurance, you may obtain prompt and effective reimbursement, which lessens the financial strain and administrative difficulties brought on by unforeseen delays.

-

However, parametric insurance is more than simply a safety net for your finances; it may be a ray of hope in difficult times, providing comfort and confidence when you need it most. It's the knowledge that you have a companion by your side who is prepared to offer support and aid at every turn, regardless of the unforeseen tribulations that may occur along your trip.

-

You're hoping that your insurance company would respond to you quickly and compensate you for the discomfort and interruption caused by the flight delay, even if you have parametric insurance. And when word of the parametric insurance payout comes through, it's accompanied by a feeling of relief and thankfulness, a reminder that, even in the face of hardship, resources and support networks are available to help you confront life's obstacles head-on with fortitude and bravery.

-

Due to the value it is bringing to insurance companies and parametric insurance customers, insurance companies need to adopt technologies to make every process easy and faster. With the adoption of the latest technologies, insurance companies can also reduce costs and improve the customer experience.

Why Do We Need Parametric Insurance

1. Faster Payouts

- Parametric insurance provides rapid payments, which are triggered by predetermined criteria like certain weather conditions or event thresholds. In the case of a covered loss, this prompt distribution of money gives policyholders rapid financial assistance, enabling them to attend to pressing demands without delay.

2. Predictable Coverage

- Policyholders who purchase parametric insurance benefit from predictability in the face of unforeseen circumstances since it makes clear under what circumstances benefits will be made. Because of this openness, customers can better comprehend their coverage and make risk-informed plans.

3. Non-Physical Loss Protection

- Non-physical losses that conventional insurance plans would not cover can be covered by parametric insurance. It can, for instance, cover lost income from bad weather, delayed flights, or other scheduled occurrences, offering financial stability in addition to material losses.

4. Customization Options

- Parametric insurance contracts can accommodate individual clients' unique demands and risk profiles. Insurance companies allow consumers to modify trigger conditions, coverage limits, and payout structures to meet their needs, providing flexibility and individualized protection.

5. Complement to Traditional Insurance

- Parametric insurance can complement traditional insurance coverage by filling gaps in protection or providing additional financial security for specific risks. Customers may opt for parametric insurance to supplement existing policies, enhancing their overall risk management strategy.

6. Risk Management Tool

- As a proactive risk management tool, parametric insurance assists clients in reducing the financial effect of unanticipated catastrophes. Through parametric coverage, clients may shift particular risks to insurers and safeguard their assets and operations against future losses.

Challenges That Insurance Companies Face In Parametric Insurance

1. Inefficient Risk Assessment

- Insurance companies may struggle to assess risk efficiently due to reliance on manual processes and outdated risk models. This can lead to delays in identifying emerging risks, inaccuracies in risk evaluations, and inadequate pricing of insurance products. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

2. Limited Customization

- Traditional risk assessment and underwriting methods may lack the flexibility to tailor insurance products to the specific needs and preferences of individual clients. As a result, insurance companies may offer standardized products that do not fully meet their clients' unique requirements. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

3. Manual Data Processing

- Processing data manually requires time, resources, and error-proneness, especially when handling large amounts of data. Insurance businesses would find it difficult to effectively gather, process, and analyze data, which might cause delays in decision-making and higher operating expenses. Due to the rise in demand par, metric insurance companies can not process all the customer data simultaneously, and it will take time to process all the customer data. Because of this, insurance companies can not fulfill all the customer demands, and customers will move further to other insurance companies. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

4. Reactive Risk Management

- Insurance companies may rely on reactive risk management strategies that are less effective in anticipating and mitigating risks. This can result in increased vulnerability to adverse events and higher claims payouts. They can't proactively monitor developing risks and take timely preventative action, which makes businesses subject to unanticipated occurrences and market swings. Consequently, insurance businesses could always be catching up to the times, responding to emergencies instead of averting them. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

5. Inaccurate Claims Assessment

- Insurance businesses could have trouble with faulty claims assessment procedures using traditional methods. Parametric insurance uses real-time data streams and specified triggers for automated payouts based on predetermined events or conditions like crop failures or natural disasters. Insurance companies can have trouble appropriately calculating payout amounts and effectively verifying claims if they have traditional methods of data processing and analysis skills. Delays, disagreements, and policyholder unhappiness may harm the insurer's credibility and reputation in the long run. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

6. Limited Innovation

-

Insurance businesses could find it more difficult to innovate and create new parametric insurance products that are suited to changing risks and client demands with traditional methods. They might not have the sophisticated analytical tools required to extract insights from data, spot business possibilities, and create creative risk-transfer schemes.

-

Insurance businesses risk missing out on possible income streams and competitive advantages if they remain stagnant in a changing market. Insurance companies may face limitations in innovating and adapting to changing market dynamics. This can hinder the development of new insurance products, services, and business plans that take into account changing customer needs and market trends. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

7. Higher Operational Costs

- In the traditional method, optimization tools might increase insurers' overhead costs for labor-intensive operations like risk assessment, data input, and claims processing. Resource waste, duplication of work, and higher mistake rates resulting from a lack of AI-driven efficiency may also raise operational expenses. Ultimately, increased operating expenses may reduce profitability and make it more difficult for insurers to compete. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

8. Limited Scalability

- Insurance firms would find it difficult to efficiently grow their parametric insurance solutions in the traditional method as the number of rules and data increases; manual procedures become more laborious, and conventional risk assessment approaches become more laborious. This inability to scale down might make it more difficult for the insurer to take advantage of growth possibilities, branch out into new regions, and service a wider clientele. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

9. Reduced Speed and Agility

- Underwriting, policy issuance, and claims settlement are three critical procedures in which insurance businesses may face delays without AI-driven automation and decision-making skills. This slowness and indecision can lead to lost opportunities, higher customer attrition, and a decline in market share. Manual processes and legacy systems may slow decision-making, product development, and response times to customer inquiries or market changes. This lack of speed and agility can hinder the company's competitiveness and responsiveness in a fast-paced industry. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

10. Compliance and Regulatory Risks

- Regulatory compliance is essential to the insurance industry, especially in parametric insurance, where specific triggers and payout criteria must be predetermined. Without AI-powered compliance monitoring and risk assessment solutions, insurance businesses can find it challenging to remain up-to-date with changing legislation and guarantee adherence to compliance requirements. As a result, insurers may be subject to penalties, legal ramifications, and regulatory concerns. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

11. Customer Dissatisfaction

- Ultimately, parametric insurance customers may become less satisfied if AI is not implemented. Policyholders anticipate streamlined online transactions, quick claim handling, and customized insurance options. Insurance firms that still use antiquated technology and manual procedures risk falling short of these standards, leading to unhappy clients, bad press, and customer attrition. This can be a challenge if insurance companies do not adopt AI in parametric insurance.

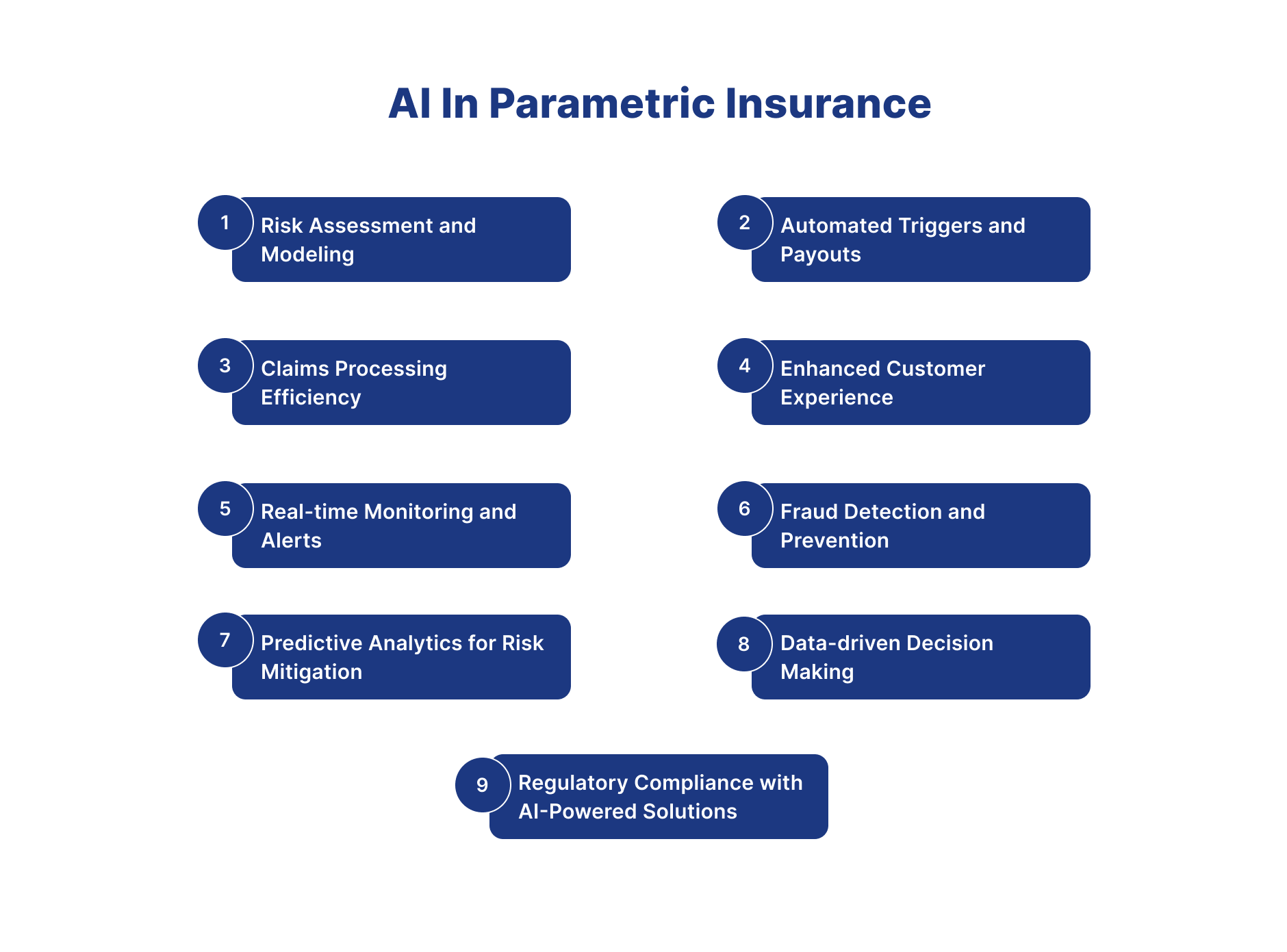

AI In Parametric Insurance

1. Risk Assessment and Modeling

- To precisely determine risk characteristics, AI-powered algorithms may Examine enormous volumes of data from many sources, such as satellite images, IoT devices, weather stations, and historical records. Machine learning algorithms can also find correlations, trends, and patterns in data to increase risk modeling and pricing accuracy for parametric insurance products. In this way, AI in parametric insurance can be used.

2. Automated Triggers and Payouts

- AI-based systems can automatically trigger payouts using real-time data inputs and pre-established parameters. They can also automatically commence reimbursements when triggers are satisfied by monitoring pertinent metrics like agricultural yields, seismic activity, and weather. This reduces the need for manual involvement and speeds up claims settlement. In this way, AI in parametric insurance can be used.

3. Claims Processing Efficiency

- AI-driven automation can expedite claims processing workflow by more quickly and accurately evaluating eligibility requirements, identifying fraud, and analyzing claim data. From unstructured claim papers, natural language processing (NLP) algorithms can extract pertinent information, and predictive analytics can spot suspicious trends that point to possible fraud. Claim TAT also improves. In this way, AI in parametric insurance can be used.

4. Enhanced Customer Experience

- Chatbots and virtual assistants driven by artificial intelligence (AI) may offer policyholders individualized support by responding to their questions, explaining their policies, and helping them through the claims procedure. Chatbots with natural language understanding (NLU) skills may have meaningful discussions, address client problems, and provide proactive help, improving the customer experience. In this way, AI in parametric insurance can be used.

5. Real-time Monitoring and Alerts

- When preset criteria are surpassed, AI algorithms can monitor pertinent metrics and produce real-time warnings or notifications. For instance, AI-based systems may monitor seismic activity, wind speeds, or flood levels and notify insurers and policyholders of imminent hazards in parametric insurance for natural catastrophes. This enables prompt reaction and risk mitigation measures. In this way, AI in parametric insurance can be used.

6. Fraud Detection and Prevention

- Large-scale datasets may be analyzed using AI-driven fraud detection algorithms, which can then be used to spot suspicious trends, abnormalities, and inconsistencies that point to fraudulent activity. By comparing claim specifics with past data, transaction patterns, and behavioral markers, machine learning algorithms may identify fraudulent claims in real-time, minimizing losses and maintaining the integrity of parametric insurance plans. In this way, AI in parametric insurance can be used.

7. Predictive Analytics for Risk Mitigation

- Predictive AI-driven analytics can anticipate future trends and hazards using previous data, market dynamics, and environmental elements. Insurance companies may improve overall risk management and profitability by using predictive modeling to proactively adopt risk mitigation tactics, optimize coverage offers, and adjust parametric insurance products to changing market circumstances. In this way, AI in parametric insurance can be used.

8. Data-driven Decision Making

- Artificial intelligence (AI) technologies empower insurance businesses to make data-driven choices by providing actionable insights, predictive analytics, and scenario planning capabilities. To satisfy changing customer and market demands, insurers may leverage AI to improve underwriting practices, adjust risk pricing models, and customize parametric insurance products. In this way, AI in parametric insurance can be used.

9. Compliance and Regulatory Compliance

- AI-powered solutions may assist insurance businesses in ensuring compliance with legal requirements and data protection rules by automating compliance monitoring, audit trails, and reporting procedures. By integrating compliance controls into AI algorithms and decision-making frameworks, insurers may reduce regulatory risks, respect industry norms, and keep stakeholders' trust. In this way, AI in parametric insurance can be used.

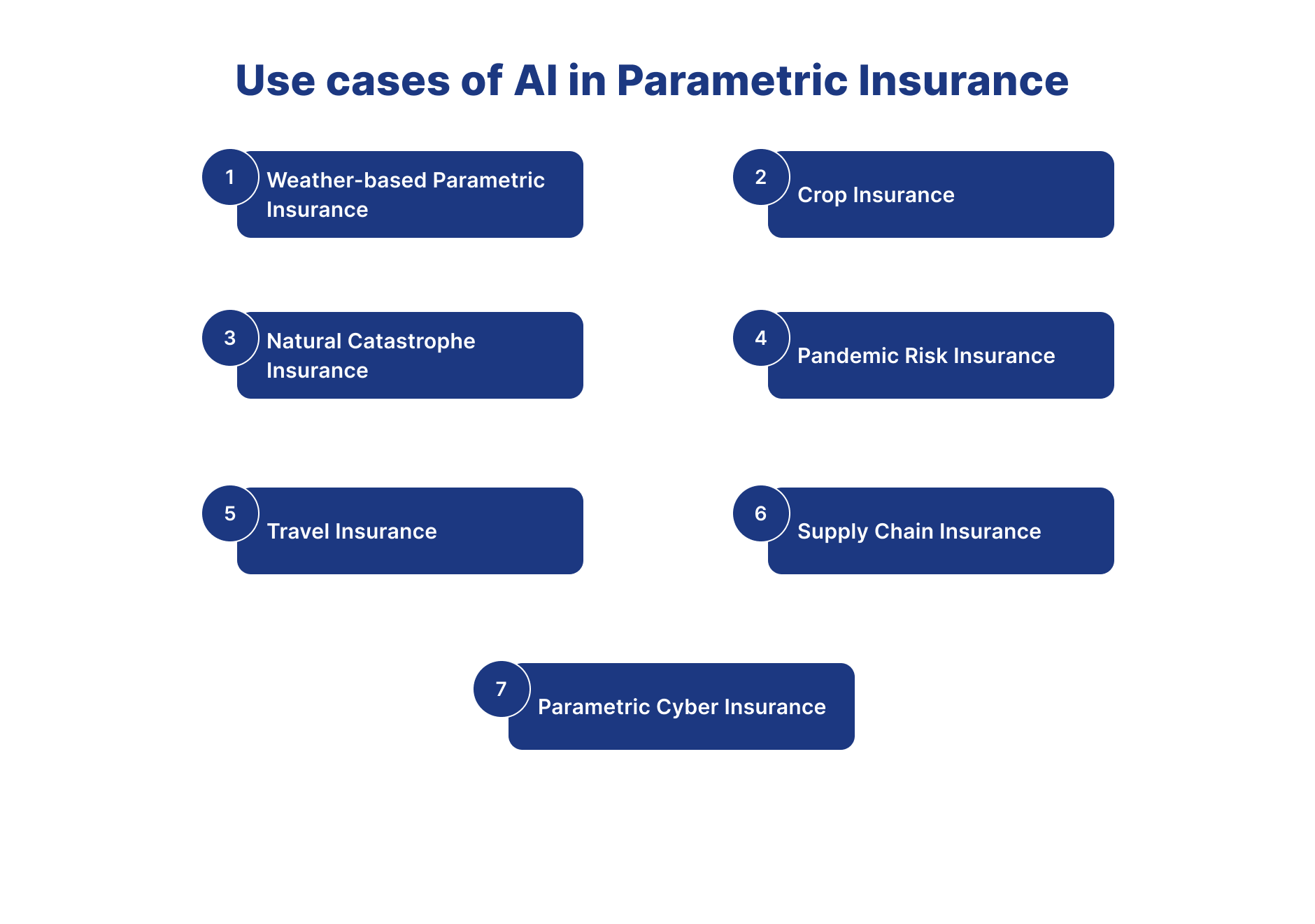

Use cases of AI in Parametric insurance

1. Weather-based Parametric Insurance

- Artificial intelligence (AI) systems can examine satellite images, historical weather data, and climate models to anticipate weather-related hazards like hurricanes, floods, or droughts. With this information, insurers may create parametric insurance plans, which pay out automatically when certain meteorological conditions are satisfied, such as wind speed or precipitation levels. This can be used in cases of AI in parametric insurance.

2. Crop Insurance

- Drones and satellites equipped with artificial intelligence (AI) can take high-definition photos of farmlands to evaluate crop health, soil moisture content, and prospective yield. Combining machine learning techniques with this data, insurers may create parametric crop insurance policies that provide prompt reimbursements to farmers in the case of crop loss due to unfavorable weather conditions or insect infestations. This can be used in cases of AI in parametric insurance.

3. Natural Catastrophe Insurance

- Artificial intelligence (AI)- powered risk modeling systems can mimic the impacts of natural calamities, such as earthquakes, wildfires, and tsunamis, on infrastructure and insured assets. Insurers may use these models to estimate possible losses, establish suitable coverage limitations, and determine the cost of parametric insurance plans appropriately. These can be use cases of AI in parametric insurance.

4. Pandemic Risk Insurance

- Parametric insurance solutions have gained popularity in the aftermath of the COVID-19 pandemic to reduce revenue losses and business interruptions caused by the pandemic. Artificial intelligence (AI) algorithms can analyze economic indicators, disease transmission models, and epidemiological data to create parametric insurance products that offer businesses impacted by pandemics quick access to financial relief. This can be used in cases of AI in parametric insurance.

5. Travel Insurance

- Depending on their itinerary, destination, and risk tolerance, travelers may receive individualized travel insurance recommendations via AI-powered chatbots and virtual assistants. Insurers may improve customers' travel insurance experience by automating policy sales, claims processing, and customer support services using natural language processing (NLP) capabilities. This can be used in cases of AI in parametric insurance.

6. Supply Chain Insurance

- Supply chain monitoring systems with AI capabilities can measure key performance indicators (KPIs) in real time, including manufacturing output, inventory levels, and transportation logistics. Using this data, insurers may create parametric insurance plans that provide monetary security against labor strikes, natural disasters, and geopolitical upheavals interrupting the supply chain. This can be used in cases of AI in parametric insurance.

7. Parametric Cyber Insurance

- AI-driven cybersecurity technologies can instantly detect and respond to cyber threats, reducing the effects of ransomware attacks, data breaches, and network failures. Parametric cyber insurance solutions allow insurers to designate cyber risk indicators, including malware infections or attempted data exfiltration, to trigger payouts automatically. This can be used in cases of AI in parametric insurance.

Conclusion

-

In conclusion, the effective administration and execution of parametric insurance solutions depend heavily on integrating artificial intelligence (AI) technology. Without AI in parametric insurance, insurance businesses could have difficulty correctly estimating risks, handling claims, and satisfying client expectations quickly and effectively.

-

In summary, AI in parametric insurance is a catalyst for innovation and change in the insurance sector, and it is not only a technical instrument. By adopting AI-driven solutions, insurers can confidently handle the difficulties of parametric insurance and set themselves up for long-term success in the changing digital economy.

Contact Us

Frequently Asked Questions

How do AI agents enable parametric insurance automation?

AI agents enable parametric insurance by monitoring trigger events through IoT sensors and satellite data, automatically validating parametric conditions, calculating payouts based on predefined parameters, and processing claims without traditional loss adjustment.

What role does real-time data play in AI-powered parametric insurance?

Real-time data from weather stations, satellites, and IoT devices allows AI to instantly detect trigger events, validate parametric conditions, and automate claim payouts, eliminating the need for lengthy claims investigations.

How does AI improve parametric insurance product design?

AI improves product design by analyzing historical data patterns, identifying optimal trigger thresholds, modeling correlation risks, and creating more accurate parametric structures that better reflect actual loss experiences.

What are the benefits of AI in parametric insurance claims processing?

Benefits include instant claim validation, automated payout processing, reduced administrative costs, elimination of moral hazard, faster customer relief, and transparent, objective claim settlements based on measurable parameters.