AI in Insurance Sector: Redefining Customer Interaction

Introduction

- Artificial intelligence (AI) has revolutionized a wide range of sectors. Because of its capacity to improve customer experience, automate processes, and extract insights from data, Artificial intelligence (AI)-based platforms and technologies are revolutionizing the insurance business by empowering brokers and insurers to provide their clients with more individualized and superior services.

- In this blog, we'll explore how AI in insurance sector is improving customer experience and how these technologies are helping clients to choose their coverage wisely, get quicker and more accurate help with claims, and receive tailored services that are tailored to their particular requirements.

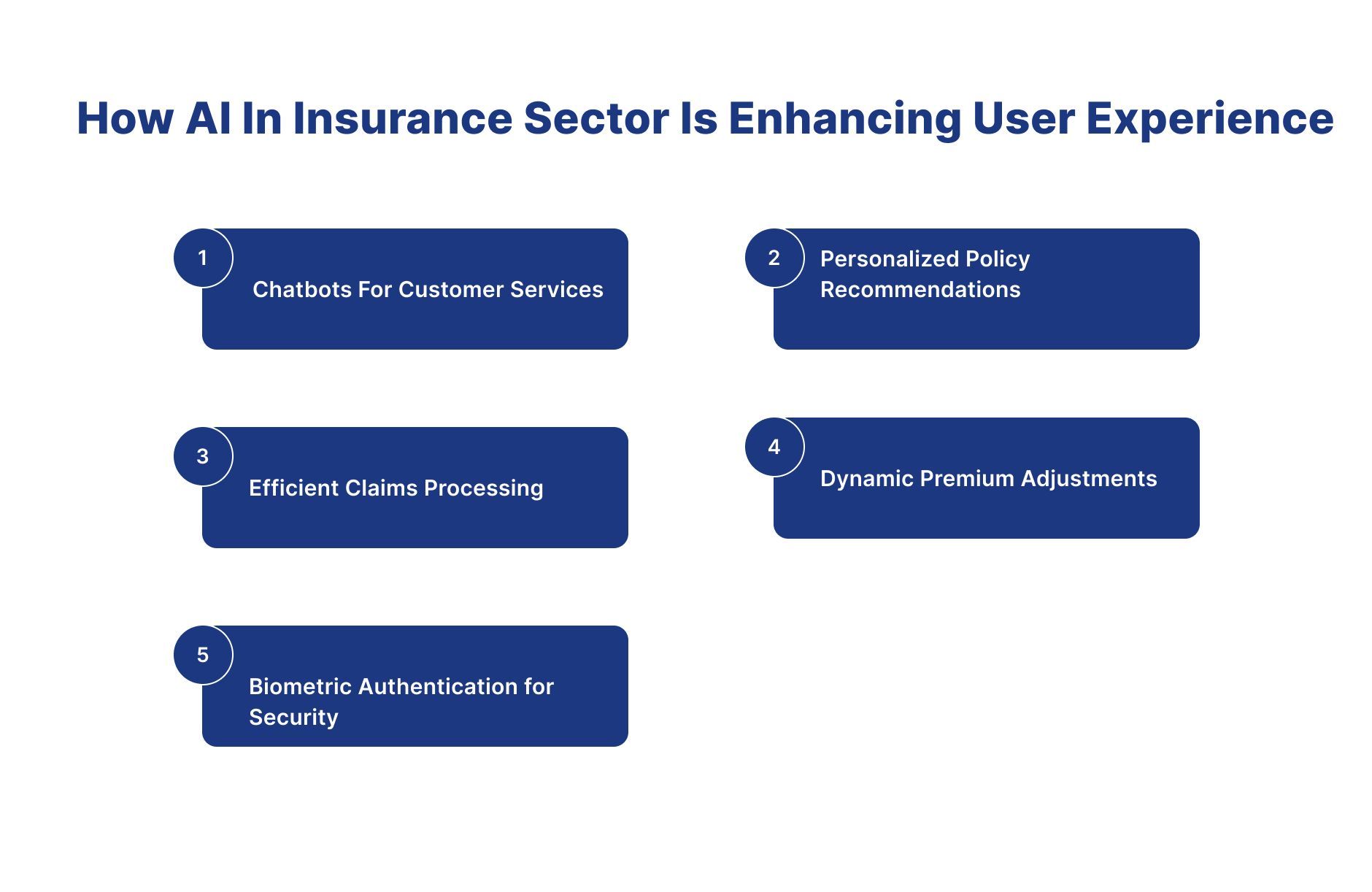

How AI in insurance sector is Enhancing user experience

- AI is enhancing user experience in the insurance sector by automating claims, offering personalized policy suggestions, and providing instant 24/7 support. It makes insurance faster, smarter, and more customer-centric.

1.chatbots for customer services

-

In the pre-AI era, insurance companies needed to hire employees who could solve customer queries by giving the answers to the customers' queries. When a company hires a new employee in the customer service department, they need to provide training to that employee every time, which is costly and time-consuming. Sometimes, employees do not understand the customer's query, and because of this, they can give wrong answers to the customer's query. Employees can work for a limited time. After some time, they will need to take a break because of this company can not provide 24/7 customer service.

-

with the help of AI in insurance sector Automated customer care is one of the main ways artificial intelligence improves the insurance user experience. These days, AI-driven chatbots can handle standard client inquiries, manage claims, and offer round-the-clock rapid support. This lowers response times while guaranteeing that clients receive accurate and timely information, raising customer satisfaction. With the implementation of AI, companies can solve the customer's query in real time and give an accurate solution to their query.

2.Personalized Policy Recommendations

- In the pre-AI, if the customer wants to purchase a new policy, then insurance companies will give the same recommendation of the policy to all their customer. This will lead to the customer not getting the policy recommendation they want, so the customer will not purchase the new policy from the same insurance company. They did not analyze the customer data to recommend the insurance policy. This will lead to insurance companies will lose their regular customers.

- AI algorithms will analyze Large volumes of data to comprehend each consumer's unique requirements and preferences. Insurance firms may now provide users with customized policy recommendations thanks to this. AI in insurance sector ensures consumers obtain plans that precisely match their needs by considering variables like lifestyle, demographics, and past data.

3.Efficient Claims Processing

-

The pre-AI insurance company has a separate department where employees will handle all the claim process. In this process, the customer will first apply for the claim; then, the employee will find their policy and analyze it. After that, if the accidental part is covered in the policy accidentally, the employee will examine that part and decide whether to approve the claim.

-

AI in insurance sector simplifies processes By automating fraud detection, processing, and claim validation. Algorithms for computer vision and machine learning can evaluate damage from photos, which eliminates the need for much paperwork and speeds up the claims settlement procedure. In addition to saving time, this effectiveness raises customer confidence in the insurance company.

4.Dynamic Premium Adjustments

-

In the pre-AI era, insurance companies will charge the same premium amount to all their customers. The insurance company did not analyze the customer data like in vehicle insurance, how the customer will drive the car in health insurance, what the patient's condition in health insurance, etc.. all these factors will help the insurance company set the policy price. If the insurance company applies this process in the premium prices, it will be time-consuming and very costly.

-

AI in insurance sector can process and analyze large information quickly and insurance companies may dynamically change premiums in response to shifting conditions. AI can detect changes in policyholder behavior, such as implementing security measures or adopting safer practices, and adjust premiums appropriately. This encourages equity and gives consumers credit for doing responsibly.

5.Biometric Authentication for Security

-

The insurance business mostly depended on antiquated authentication techniques, which were frequently vulnerable, to secure critical data in the pre-digital age. Biometric authentication was introduced in the insurance industry because of the necessity for a strong security framework, which marked a revolutionary change in how user data was protected.

-

In the insurance sector today, biometric authentication is a strong security pillar. Insurers can accurately verify policyholder identities by utilizing cutting-edge technology like voice authentication, facial recognition, and fingerprint scanning. This advanced security feature removes the need for complicated passwords or PINs while streamlining user experiences and safeguarding critical transactions. Biometric authentication is a major step forward in the industry's commitment to digital security since it protects against fraud and unauthorized access while also boosting policyholder confidence. Ai in insurance sector can analyse the biometric data using historical data of the customer. this will provide additional security to insurance companies and customers.

Conclusion

- In conclusion, with the help of AI in insurance sector the insurance industry is seeing more revolutionary shifts, with a more technologically sophisticated and user-centric environment emerging. Users may expect more inventive, efficient, and personalized experiences with insurance companies as AI technologies advance.

How Insurnest will help you adapt AI in your company

-

At Insurnest, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Insurnest's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

How is AI reshaping the insurance sector globally?

AI is reshaping insurance through automated underwriting, predictive risk modeling, personalized pricing, fraud detection, customer service automation, and data-driven decision making across all insurance lines.

What are the key AI technologies transforming insurance operations?

Key technologies include machine learning for risk assessment, natural language processing for document analysis, computer vision for damage evaluation, predictive analytics for forecasting, and robotic process automation for workflow efficiency.

How does AI improve risk assessment in the insurance sector?

AI improves risk assessment by analyzing vast datasets, identifying hidden patterns, processing real-time data feeds, creating dynamic risk models, and enabling more accurate pricing based on individual risk profiles.

What challenges does the insurance sector face in AI adoption?

Challenges include regulatory compliance, data quality issues, legacy system integration, talent acquisition, ethical AI concerns, and balancing automation with human oversight for complex decisions.