AI In Insurance Claim: 5 Ways To Implement AI To Modernize The Claim Process In The Insurance Industry

Introduction

- AI in insurance claim processing is a transformative lighthouse in the ever-changing insurance business, where speed and precision are critical. Imagine a future in which claims are handled and expertly coordinated by sophisticated algorithms, significantly decreasing wait times, mistakes, and complexity. The transition from conventional claims processing to the application of AI is like opening a new territory where efficiency and creativity coexist. In this investigation, we explore the fascinating ways artificial intelligence (AI) is not just simplifying but also revolutionizing the fundamentals of insurance claims, providing a window into a future in which the insurance experience is highly intelligent and efficient.

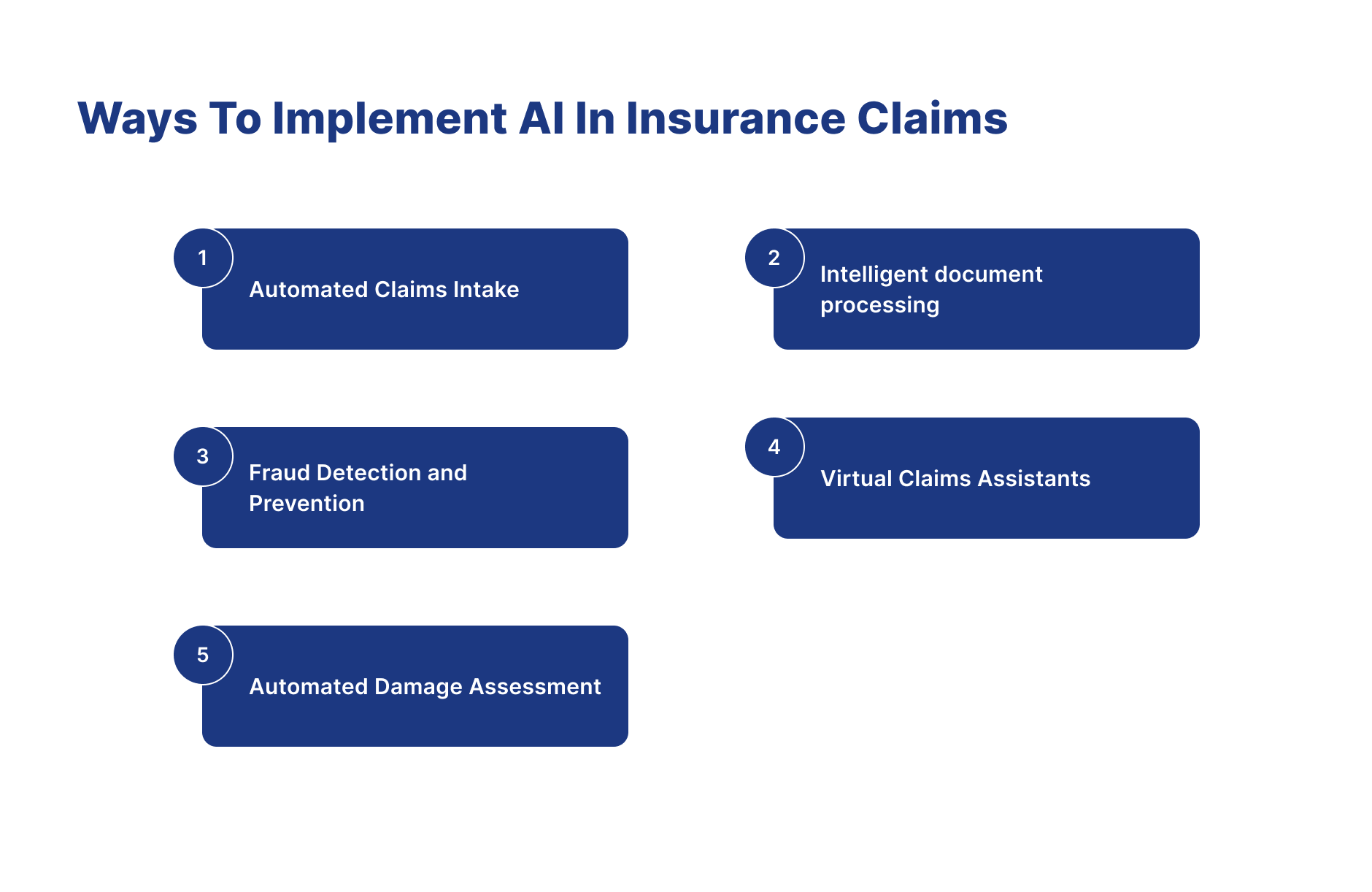

What Are the Best Ways to Implement AI in Insurance Claims?

- The best ways to implement AI in insurance claims include automating document processing, using predictive analytics for fraud detection, and deploying chatbots for real-time updates. Insurers should start with high-volume workflows, integrate AI with core systems via APIs, and maintain human oversight to ensure accuracy, compliance, and trust.

1.Automated Claims Intake

-

In the traditional way of claim processing, customers need to visit or call an insurance company to make a procedure for claim processing. The insurance company must also create a separate department where customers visit or call to start a claim process. Because of this, they will need to hire an employee who can handle it. The customer may be unable to connect with the claim processing department, leading to the claim process not being started on time.

-

But if the insurance company adopts AI in insurance claim , then the claim intake process gets automated. Customers do not need to visit the insurance company or make a call. They only need to fill in some details required for digital claim processing. Customers can start this process whenever they want and fill in the required information from a mobile device or desktop.

2.Intelligent document processing

-

In the pre-AI era, customers had to submit the document physically by visiting the insurance company or through the insurance agent. The insurance company will verify the document, and after that, they will decide whether to start the claim process or not. This might be time-consuming, and the customer did not get the claim on time.

-

However, after adopting AI in insurance claim, AI can be use in document processing, when the customer uploads the documents in real time, AI will verify it and decide whether to approve the claim. Because of implementing AI in document verification, customers get the claim on time.

3.Fraud Detection and Prevention

-

In the traditional way of detecting and preventing fraud, if fraud happens with the customer, then the customer will register their complaint about the fraud in the insurance company, and the insurance company will tell their employee to investigate the fraud. This will take time, and sometimes customers are unable to connect with the insurance company, and because of that, they will be unable to tell the company about the fraud.

-

However, AI will use machine learning to identify fraud after implementing AI in insurance claim then AI will use in fraud detection and prevention. Insurance companies only need to train the AI model on the detection and prevention of fraud, and on the basis of data and training, AI can stop it because of that not get affected by fraud easily.

4.Virtual Claims Assistants

-

In traditional claim assistance, the insurance company will provide an employee to the customer, and after that, the employee will make all the procedures related to the claim process. He will verify the document, verify the damaged part, and make a decision about whether to approve the claim or not. Sometimes, employees are unable to finish the entire process in time, and because of this, customers do not get the claim on time.

-

After implementing AI in insurance claim assistance, the customer only needs to submit the document on the website, and the AI initiates a further process. Ai will verify the document and also verify the damaged part, and on the basis of that, it will decide whether to approve the claim or not.

5. Automated Damage Assessment

- In the physical damage assessment, the insurance company will provide one employee to the customer who will evaluate the damage and determine whether to approve the claim. Sometimes, because of the employee shortage, the insurance company cannot provide the employee to the customer, and because of this, the customer does not get the claim on time. Sometimes, employees also make some mistakes in the assessment of the damage.

- However, after adopting Ai in insurance claim , customers only need to share the images of the damaged part. AI will decide whether to approve the claim based on the images. This process is less time-consuming and less costly; the customer gets the claim on time.

Conclusion

- In conclusion, Using AI in insurance claim processing is a crescendo of efficiency, speed, and unmatched precision in the symphony of innovation and advancement. When we compare the before and after environments, the conventional barriers of manual procedures, paperwork, and delays are being replaced by a future where claims are processed with never-before-seen speed and intelligence. AI-driven automation has made the system more efficient and completely changed the definition of claims processing, turning it into a dynamic and adaptable system.

How Insurnest will help you implement AI in the claim processing

-

At Insurnest, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Insurnest's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

How does AI revolutionize insurance claim management?

AI revolutionizes claim management through automated first notice of loss processing, intelligent claim routing, predictive claim outcomes, real-time fraud detection, and automated settlement for routine claims.

What AI techniques are used for claim damage assessment?

AI uses computer vision for photo analysis, machine learning for damage pattern recognition, predictive modeling for repair cost estimation, and natural language processing for extracting information from claim descriptions.

How does AI improve claim adjuster productivity?

AI improves productivity by automating routine tasks, providing risk scores and recommendations, prioritizing high-value claims, generating preliminary assessments, and enabling adjusters to focus on complex cases requiring human judgment.

What role does predictive analytics play in AI-driven claims processing?

Predictive analytics forecasts claim costs, identifies potential fraud risks, predicts claim duration, estimates settlement amounts, and helps optimize resource allocation for claim handling teams.