10 Smart Ways AI Prevents Fraud in Insurance

Introduction

- AI in fraud prevention is a revolutionary protagonist in the ever-changing story of the insurance business. Imagine a digital watchdog that is always monitoring the data corridors, destroying lies, and bolstering the walls of confidence. This blog explores the fascinating ways that artificial intelligence (AI) is changing fraud prevention beyond simply being a technical instrument, but rather a sentinel that is redefining security itself as we traverse the frontiers of innovation. Come along on an exciting adventure where accountability meets algorithms and artificial intelligence (AI) stands out as the front-runner against the shadow of fraud in the insurance sector.

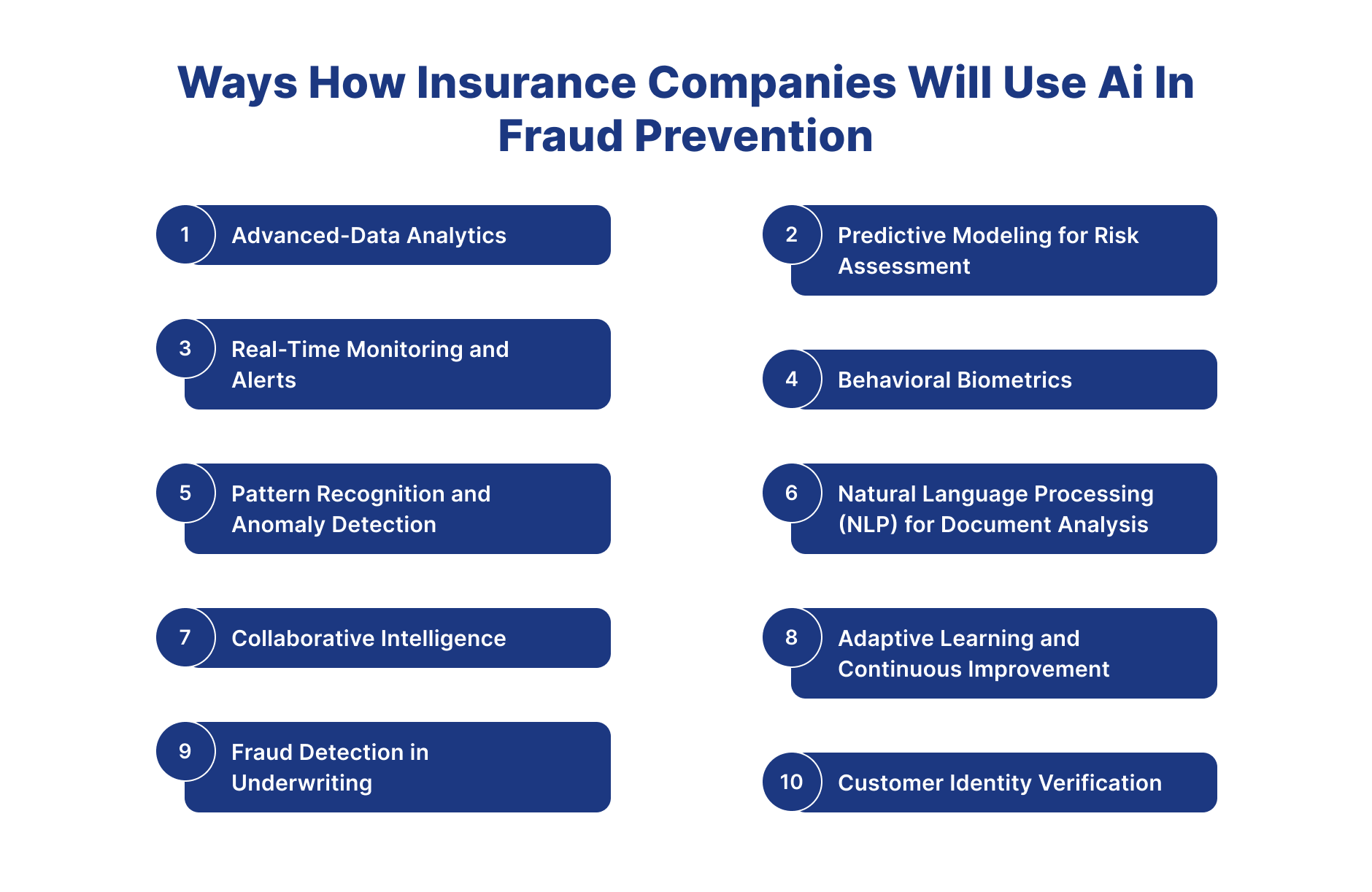

What Are the Ways Insurance Companies Use AI to Detect and Prevent Fraud?

Insurance companies use AI to detect and prevent fraud by analyzing claim patterns, identifying anomalies, and scoring risks in real time. AI models cross-check data from multiple sources, flag suspicious behavior, and automate investigations, helping insurers reduce false claims, detect fraud earlier, and protect customers with greater accuracy.

1.Advanced-Data Analytics

- The ability of AI to analyze data is revolutionary for preventing fraud. Large volumes of data may be sorted through machine learning techniques, which subsequently find patterns, abnormalities, and minute deviations that human analysts would otherwise miss. This makes it possible to identify possible fraudulent activity early on. this way insurance companies can use ai in fraud prevention.

2.Predictive Modeling for Risk Assessment

- Because AI is so good at predictive modeling, insurers can evaluate the risk of transactions and claims. Machine learning algorithms can forecast the probability of fraud by evaluating past data, which aids insurers in prioritizing high-risk situations for more examination and research. this way insurance companies can use ai in fraud prevention.

3.Real-Time Monitoring and Alerts

- AI's ability to operate in real-time is crucial for stopping fraud before it starts. AI algorithms closely monitor claims, transactions, and user behavior. They quickly identify any questionable activity and flag it for further examination. This real-time method reduces the possible harm caused by dishonest behavior. this way insurance companies can use ai in fraud prevention.

4.Behavioral Biometrics

- AI is ushering in a new age of identity verification using behavioral biometrics. AI can generate a distinct behavioral profile for every user by examining user behavior, including typing, mouse, and even speech habits. Any departure from this profile may indicate that there may be fraudulent activity going on. this way insurance companies can use ai in fraud prevention.

5.Pattern Recognition and Anomaly Detection

- AI systems are quite good at finding patterns in data and spotting abnormalities. This capacity is essential for identifying anomalies that might point to fraud. AI can quickly identify possible problems, whether they are anomalies in policy data, unexpected claims patterns, or unusual user behavior. this way insurance companies can use ai in fraud prevention.

6.Natural Language Processing (NLP) for Document Analysis

- For parsing and analyzing massive amounts of unstructured data, like text found in claims documents, AI-powered natural language processing (NLP) is important. By interpreting the text's content and context, natural language processing (NLP) can detect discrepancies, misinformation, or warning signs that could point to fraudulent claims. this way insurance companies can use ai in fraud prevention.

7.Collaborative Intelligence

- By enabling insurers to exchange and evaluate data collaboratively, artificial intelligence (AI) promotes collaborative intelligence. By pooling expertise, the industry can create a complete database of recognized fraud trends and perpetrators, helping to keep one step ahead of emerging fraud techniques. this way insurance companies can use ai in fraud prevention.

8.Adaptive Learning and Continuous Improvement

- The capacity of AI to continually learn and adapt is one of its advantages. Artificial intelligence (AI) systems can adjust and improve detection capacities when fraudsters change their strategies. Thanks to this adaptive learning, the techniques for preventing fraud will continue to work over time. this way insurance companies can use ai in fraud prevention.

9.Fraud Detection in Underwriting

- Artificial Intelligence (AI) have the capacity to greatly influence underwriting procedures by detecting disparities or incoherencies in data submitted by applicants for insurance. Artificial Intelligence assists insurers in making better judgments and reducing the risk of fraudulent insurance by evaluating past data and comparing it with fresh submissions. this way insurance companies can use ai in fraud prevention.

10.Customer Identity Verification

- Facial recognition and biometric authentication are two examples of advanced AI technologies that improve consumer identification verification procedures. This lowers the possibility of identity-related fraud by confirming that the people dealing with insurance services are who they say they are. this way insurance companies can use ai in fraud prevention.

Conclusion

- The use of AI in fraud prevention is becoming essential to security and trust as the insurance sector embraces the digital era. AI is changing the fraud protection environment by utilizing the power of collaborative intelligence, behavioral biometrics, predictive modeling, and sophisticated data analytics. By putting money into AI technology, insurers strengthen their defenses against fraud and add to the resilience and sustainability of the insurance industry as a whole. Artificial Intelligence's transformational capacity is inextricably linked to the future of fraud prevention in the insurance business.

How Insurnest will help you in implement AI for fraud prevention in your company

-

At Insurnest, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Insurnest's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

How does AI detect fraud in insurance?

AI detects fraud by analyzing claim patterns, identifying anomalies through advanced data analytics, using predictive modeling for risk assessment, and monitoring transactions in real-time to flag suspicious activities.

What are behavioral biometrics in fraud prevention?

Behavioral biometrics use AI to analyze user behavior patterns like typing habits, mouse movements, and speech patterns to create unique behavioral profiles, detecting fraud when behavior deviates from established patterns.

How does NLP help in fraud detection?

Natural Language Processing (NLP) analyzes unstructured text data in claims documents to detect discrepancies, misinformation, or warning signs that could indicate fraudulent claims by interpreting content and context.

What is collaborative intelligence in fraud prevention?

Collaborative intelligence enables insurers to share and analyze data collectively, creating a comprehensive database of known fraud patterns and perpetrators to stay ahead of emerging fraud techniques.