5 Ways AI Simplifies Customer Onboarding for Insurers

Introduction

- The onboarding process is critical to moulding client experiences in the fast-paced world of insurance. Conventional onboarding methods can cause delays and annoyance for clients and insurance providers since they frequently entail intricate paperwork, drawn-out verification procedures, and repetitive chores. But with the use of AI in customer onboarding, insurance firms may transform their onboarding procedures to make them more seamless, effective, and customer-focused.

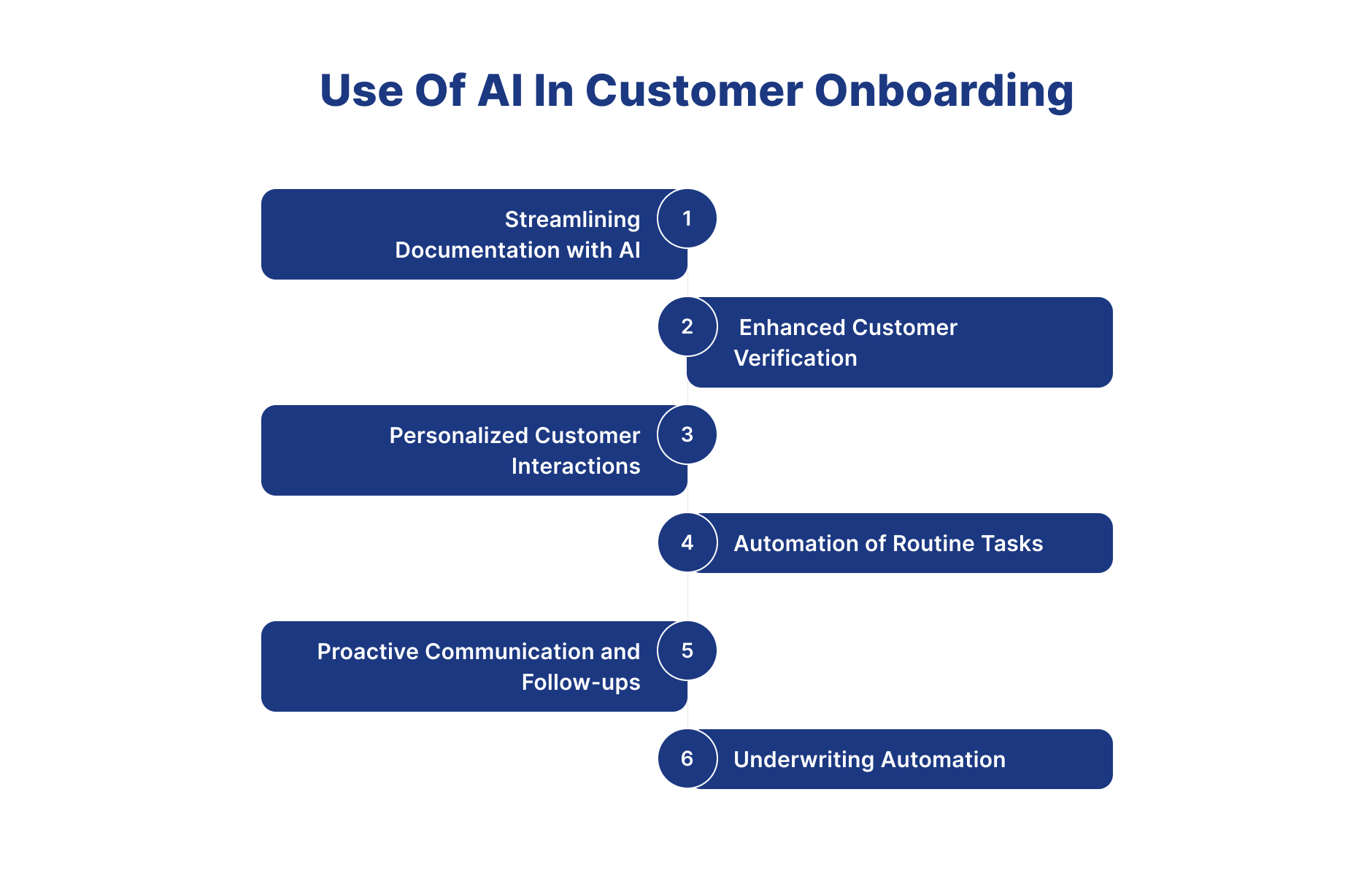

How Does AI Improve the Customer Onboarding Process in Insurance?

- AI improves the customer onboarding process in insurance by automating identity verification, simplifying document processing, and personalizing the user journey. It reduces manual errors, speeds up KYC and policy setup, and provides real-time guidance, creating a faster, smoother, and more compliant onboarding experience for customers.

1.Streamlining Documentation with AI

-

Insurance companies need to use human power in the traditional document verification process. In this process, customers need to submit documents to the insurance company physically or digitally; after that, employees will verify them. Sometimes, employees might make a mistake in document verification, which is also very time-consuming. Insurance companies need to train the employee when they hire new employees.

-

The amount of work needed to issue a policy is one of the main obstacles in the insurance onboarding process. AI-driven document processing systems may drastically reduce the time and effort required to handle paperwork. Data entry may be completed quickly and accurately thanks to the automatic information extraction provided by Optical Character Recognition (OCR) technology, a subset of artificial intelligence.

-

This reduces the possibility of human mistakes while speeding up the onboarding process. AI can also extract the information and verify it without any human interference. AI can also flag any anomalies such as tampering, wrong document type, blurred photos etc in the document. this way insurance companies can use AI in customer onboarding.

2.Enhanced Customer Verification

-

In traditional customer verification, customers need to fill out the form related to the insurance policy. In that form, customers need to give a photo and a signature. Then, the employee will compare this image and signature with the face of the customer and the signature which is drawn by the customer physically on paper. This process will take time; sometimes, employees can make a mistake in customer verification.

-

AI has the potential to improve consumer verification procedures during onboarding significantly. Biometric and facial recognition authentication technologies can be used to quickly and securely confirm applicants' identities. Insurance businesses may reduce the danger of identity theft and ensure that only qualified applicants can access their services by employing these cutting-edge methods. This way insurance companies can use AI in customer onboarding.

3.Personalized Customer Interactions

-

In the onboarding process, if a customer has a query about the insurance policy, then the customer can call the insurance company. The employee will talk with the customer on behalf of the customer and solve the query. Insurance companies must train employees when they hire new employees, which is very time-consuming and costly. Employees need to take a break after some time. Because of this, insurance companies can not provide a 24/7 query-solving process during the onboarding process.

-

Chatbots and virtual assistants driven by AI have the potential to revolutionize the onboarding process by changing how insurance businesses engage with their clients. These intelligent solutions may help clients with their onboarding process, respond to inquiries, and offer real-time support. Artificial intelligence (AI)-driven virtual assistants improve customer happiness and onboarding experiences by providing a personalized and conversational experience. This way insurance companies can use AI in customer onboarding.

4.Automation of Routine Tasks

-

Insurance companies must hire employees for routine tasks like policy generation, data validation, customer service, underwriting, lead nurturing etc. Insurance companies also need to provide training when they hire new employees. It is a very costly and time-consuming process.

-

AI can streamline repetitive onboarding procedures, allowing insurance experts to concentrate on more intricate and valuable work. Automation may drastically reduce processing times and boost productivity in various tasks, starting from lead to policy issuance. This benefits the insurance provider and guarantees clients a quick and easy onboarding procedure. This way insurance companies can use AI in customer onboarding.

5.Proactive Communication and Follow-ups

- When insurance companies get the sales lead from the customer, they need to follow up with the customer to convince them to purchase the policy. To take a follow-up, the insurance company needs to hire employees who can talk with the customer and convince them to buy the insurance policy. Some insurance companies run an email campaign to follow up with the customer. The execution of this process is time-consuming and costly.

- During onboarding, insurers may stay in proactive contact with their clients thanks to AI-powered technologies. Customers are updated about the progress of their applications, necessary documents, and next actions through automated emails, reminders, and notifications. This promotes confidence and trust in the insurance company in addition to improving openness. This way insurance companies can use AI in customer onboarding.

6.Underwriting Automation

-

Underwriting stands as a pivotal process in insurance sales, entailing multiple validations to determine policy acceptance or rejection. While a Rule Engine can automate aspects of this process, its capabilities are limited and unable to resolve interconnected patterns spanning various parameters.

-

AI extends beyond the limitations of a Rule Engine in automating underwriting. It excels in identifying interconnected patterns across parameters and discerning patterns within customer data and documents. Through AI, automated decisions can be made more comprehensively and effectively. This way insurance companies can use AI in customer onboarding.

Conclusion

-

In conclusion, Ai in customer onboarding represents a revolutionary step toward unmatched accuracy, efficiency, and client satisfaction. Imagine a day where massive amounts of documentation are easily digitized, client identities are quickly and securely confirmed, and one-on-one interactions smoothly lead people through the insurance process.

-

Under AI's direction, repetitive processes get automated, underwriting becomes an exact science, and client retention efforts are strengthened by predictive analytics. The goal isn't only to revolutionize technology; it also promises an easier, quicker, and more enjoyable onboarding process. Insurance firms are reinventing partnerships and improving procedures by utilizing AI to ensure that every onboarding experience is as great as their coverage.

How will Insurnest help you implement AI for a smooth onboarding process in your company

-

At Insurnest, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Insurnest's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

How does AI streamline insurance customer onboarding processes?

AI streamlines onboarding through automated KYC verification, document processing using OCR, risk assessment algorithms, personalized product recommendations, and digital application completion with real-time validation.

What AI technologies improve customer onboarding experience?

Technologies include natural language processing for chatbots, machine learning for risk scoring, computer vision for document verification, predictive analytics for product matching, and automated workflow orchestration.

How does AI reduce onboarding time for insurance customers?

AI reduces onboarding time by automating data entry, instantly verifying documents, pre-filling applications with available data, providing real-time eligibility checks, and eliminating manual review steps for low-risk applications.

What compliance benefits does AI provide in customer onboarding?

AI ensures compliance through automated regulatory checks, consistent application of KYC/AML rules, audit trail generation, risk-based verification processes, and real-time monitoring for suspicious activities.