Why Does AI Fail in the Insurance Industry? 10 Hidden Reasons

Introduction

- Artificial intelligence (AI) has attracted a lot of interest in various industries, including insurance. It promises improved efficiency, cost savings, and enhanced decision-making. However, despite its potential, there are instances where AI fails to deliver the expected results. Let's explore some reasons why AI fails in the insurance industry

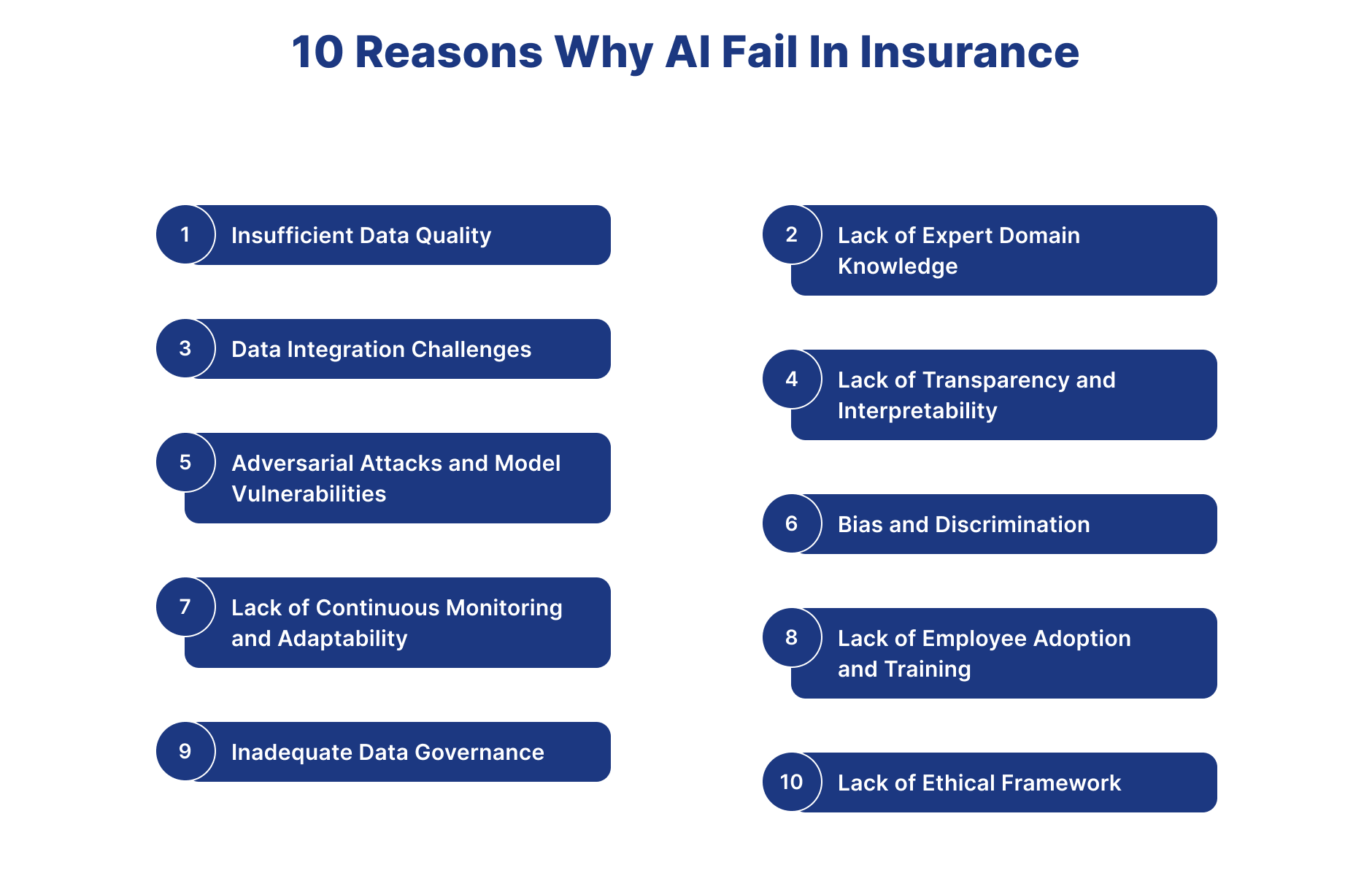

What Are the Main Reasons AI Fails in the Insurance Industry?

- AI often fails in the insurance industry due to poor data quality, lack of clear business objectives, weak change management, and overreliance on technology without human oversight. Many insurers also underestimate integration challenges, regulatory constraints, and the need for cross-functional alignment, leading to stalled projects and limited ROI.

1.Insufficient Data Quality

- Data of the highest calibre is necessary for AI systems to make reliable predictions and evaluations. Data sources in the insurance sector can be complicated and originate from several internal and external systems. The performance of AI models can be adversely affected by inadequate, erroneous, or biased data, which can result in untrustworthy insights and forecasts. because of this reason AI fail in insurance industry.

2.Lack of Expert Domain Knowledge

- Experts with domain expertise who comprehend the nuances and complexity of the insurance sector are crucial for successfully using AI. It might be difficult to decide which questions to ask, which data sources to use, and how to create models that meet certain business objectives if one does not have a thorough grasp of the insurance industry. because of this reason AI fail in insurance industry.

3.Data Integration Challenges

- Integrating and combining data from many departments, systems, and legacy platforms can be complicated for insurance businesses. It is more challenging to create complete AI models that can fully utilize the potential of the given data if the data is unavailable and silted off. Inadequate integration can restrict the capabilities and precision of AI systems, resulting in subpar outcomes. because of this reason AI fail in insurance industry.

4.Lack of Transparency and Interpretability

- Deep learning models and neural networks are two examples of AI systems that might be complicated and challenging to understand. Lack of transparency and interpretability can be major obstacle in the insurance business, where fair client treatment and regulatory compliance are crucial. Explainable AI models that can provide light on the logic behind forecasts and choices are essential for insurance businesses. because of this reason AI fail in insurance industry.

5.Adversarial Attacks and Model Vulnerabilities

- AI models in the insurance sector are vulnerable to flaws and adversarial attacks. Malicious actors and fraudsters may try to influence AI models by giving false information or taking advantage of algorithmic flaws. AI models are vulnerable to compromise without appropriate protections and strong security measures, which might result in imprecise forecasts and covert, fraudulent activity. because of this reason AI fail in insurance industry.

6.Bias and Discrimination

- The data used to train AI systems determines their quality. AI models have the potential to reinforce and even magnify preexisting discriminatory practices if the training data is biased or reflects such practices. Biassed AI models in the insurance sector may result in the unjust treatment of some clientele groups, possible legal problems, and reputational harm. because of this reason AI fail in insurance industry.

7.Lack of Continuous Monitoring and Adaptability

- To ensure AI models are operating as intended and to spot any upgrades or enhancements needed, they must be continuously monitored. Performance degradation can occur from not monitoring AI models on a frequent basis, particularly when new data patterns appear or business requirements shift. Furthermore, AI models must be flexible to pick up new information and change along with the market dynamics. because of this reason AI fail in insurance industry.

8.Lack of Employee Adoption and Training

- Employee cooperation and active engagement are necessary for implementing AI technology throughout the company. Employees could be hesitant to use new technologies without adequate training to utilize and comprehend AI tools and models. The potential advantages of AI may be undermined by this lack of acceptance and comprehension, which can also make it more difficult to use. because of this reason AI fail in insurance industry.

9.Inadequate Data Governance

- Large volumes of data are needed for AI to train models and generate precise predictions. However, data integrity and quality might be jeopardized without sound data governance procedures. Biassed models and untrustworthy results can result from poor data management, including data normalization, cleaning, and security problems. because of this reason AI fail in insurance industry.

10.Lack of Ethical Framework

- AI presents ethical questions, especially in the insurance sector, where choices may greatly influence people's lives and financial security. There is a chance of unethical behavior or unforeseen repercussions when implementing AI without a clear ethical framework. Creating and upholding ethical standards is necessary to guarantee AI's impartial and responsible application in the insurance industry. because of this reason AI fail in insurance industry.

Conclusion

- In conclusion, even though artificial intelligence (AI) has a lot of promise for the insurance sector, there are several reasons why it could not produce the expected outcomes. Insurance firms may successfully negotiate the complexity of AI deployment and optimize its advantages by resolving data quality, knowledge, transparency, bias, employee adoption, and regulatory compliance issues. The insurance sector can only successfully deploy AI if it takes a deliberate, strategic approach and continues monitoring and adjusting.

How Insurnest will help you in implementing AI in your insurance company

-

At Insurnest, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Insurnest's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are the main reasons AI implementations fail in insurance?

AI implementations fail due to poor data quality, lack of clear business objectives, insufficient change management, over-automation without human oversight, and inadequate integration with existing systems.

How can insurance companies avoid AI implementation failures?

Companies can avoid failures by starting with pilot programs, ensuring data quality, setting realistic expectations, providing proper training, and maintaining human oversight for critical decisions.

What role does data quality play in AI success in insurance?

Data quality is crucial as AI models require clean, structured, and comprehensive data to make accurate predictions and decisions. Poor data leads to biased outcomes and unreliable automation.

Why is change management critical for AI adoption in insurance?

Change management is critical because AI transforms workflows and job roles. Without proper training and communication, employees may resist adoption, leading to poor utilization and project failure.